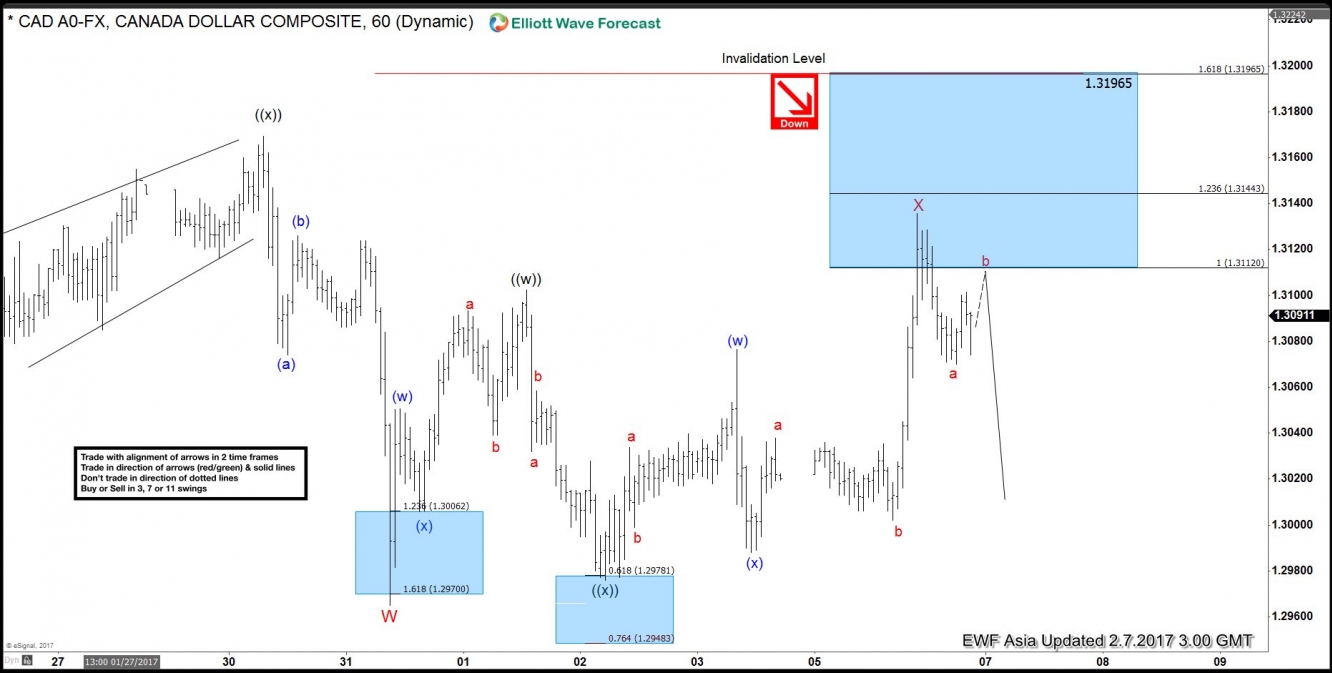

Short-term Elliottwave sequence in USD/CAD is showing a 5 swing bearish sequence from 1/20 high, suggesting more downside is likely. Decline to 1.2965 ended Minor wave W and Minor wave X bounce is unfolding as a double three where Minute wave ((w)) ended at 1.3102, Minute wave ((x)) ended at 1.2976, and Minute wave ((y)) of X is proposed complete at 1.3136.

Near term, while bounces stay below 1.3136, but more importantly as far as pivot at 1/20 high (1.3388) remains intact, expect USD/CAD to resume lower. If pair breaks above 1.3136, it can be doing a FLAT correction from 1/31 low and extend one more leg higher towards 1.3144 - 1.3196 area in Minutte wave (v) of ((c)) before wave X bounce is complete. Even in the event that pair breaks above 1.3136, pair is still expected to resume to new low as far as pivot at 1.3388 stays intact. We don't like buying the pair.