Long Term Blue Chip Stock

Cato Corporation (Cato)

- Current: $25.96

- Long-Term Target: $40.11

The Cato Corporation is a women's fashion specialty retailer. As of January 28, 2012, the Company operated 1,288 fashion specialty stores in 31 states, principally in the southeastern United States, under the names Cato, Cato Fashions, Cato plus, it’s Fashion, its Fashion Metro and Versona Accessories. It operates in two segments: stores and Credit.

The Company's stores offer an assortment of on-trend apparel and accessory items in primarily junior/missy, plus sizes, girls sizes 7 to 16, men's and kids sizes newborn to seven. Its merchandise lines include dressy, career, and casual sportswear, dresses, coats, shoes, lingerie, costume jewelry, handbags, men's wear and lines for kids and newborns. Its merchandise is sold under its private label and is produced by various vendors in accordance with the Company's specifications. John P. D. Cato Chairman, President and Chief Executive Officer Of Company

Fundamentals:

- Market Cap - 796.5M

- Shares Outstanding - 29.3M

- Price/Earnings- 12.4x

- Revenue (TTM)-933.7

- Earnings per Share-2.19

- Dividend + Yield-1.00 (3.68%)

- Beta-.75

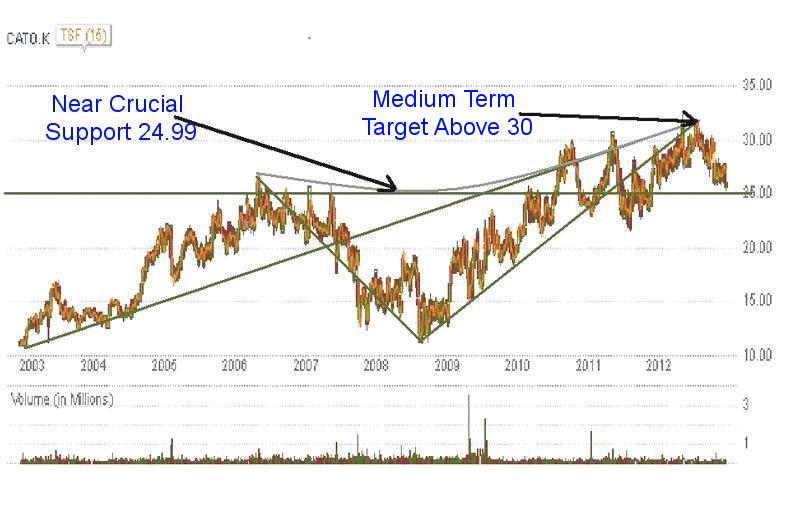

Cato Corporation is showing a bull flag in an up trend, which shows a bullish trend above $24.99. Buy on the decline with strict stop loss at 24.99 and a medium-term target above 30. Five-years charts create a symmetrical triangle in up trend. Buy at every decline with stop loss at 24.99 and a target of 40.11.