Heavy machinery maker Caterpillar (NYSE:CAT) stock has been selling off after peaking in April 2021. The Company has been a major benefactor of the post-pandemic reopening representing construction and infrastructure demand. However, investors may feel the best times are in the rearview mirror as illustrated by the (-20%) pullbacks from its peak. The Company has been upfront about the disruptions from supply chain disruption and rising inflation in materials and commodities costs. Shares are starting to stage a rebound. Prudent investors who are optimistic about construction spending and the passage of the infrastructure bill can watch for opportunistic pullback in shares of Caterpillar.

Q3 FY 2021 Earnings Release

On Sept. 2, 2021, Caterpillar released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) profit of $2.66 excluding non-recurring items versus consensus analyst estimates for a profit of $2.21, a $0.45 beat. Revenues grew 25.5% year-over-year (YoY) to $12.4 billion falling short of analyst estimates for $12.46 billion. Operating profit margin was 13.4% compared to 10% in the year ago same quarter. Construction Industries rose 30% YoY to $5.225 billion. Resource Industries sales rose 32% to $2.406 billion. Energy & Transportation sales rose 22% YoY to $5.077 billion.

Raised Full-Year 2021 Guidance

Toro raised its fiscal full-year 2021 guidance with EPS coming in between $3.53 to $3.57, up from $3.45 to $3.55, versus $3.57 consensus analyst estimates. Revenues are expected to grow 17% YoY to $3.95 billion versus $3.85 billion consensus estimates.

Conference Call Takeaways

Caterpillar CEO Jim Umpleby set the tone:

“We experienced supply chain challenges like many other industrial companies. We believe our sales in the third quarter would have been higher, if not for these issues. We are however pleased by our global teams ability to continue to execute in a challenging environment. Turning to Slide 4, the topline increased by 25%, primarily due to higher volumes, which was driven by strong end-user demand. Compared with the Third Quarter of 2020, sales to users rose about 14%. Sales to users rose in the three primary segments and in most regions. For machines sales to users increased by 17%. For Energy and Transportation sales to users increased 8%.”

He continued:

“We remain optimistic about demand in our three primary segments for the remainder of the year. Dealers, each of whom are independent businesses, decreased inventory by $300 million in the Third Quarter versus a decrease of $600 million in last year's Third Quarter. To put it in context, dealer inventory is about flat versus year end 2020. Reported revenues for the quarter also benefited from growth in services, favorable price, and currency.”

Supply Chain and Rising Costs

CEO Umpleby touched on disruptions including supply chain and inflation:

“Turning to the supply chain, our global team works to mitigate the challenges we encountered in the Third Quarter, which were more significant than we expected. Our suppliers also experienced availability issues and freight delays leading to pressure on production in our facilities. We put control towers in place to spotlight areas of concern across our operations and our value chain. We've proactively redirected components and altered our assembly processes as much as possible to keep output flowing. In addition, Caterpillar inventory grew by about $1 billion in the third quarter compared to the second quarter of 2021. Of the $1 billion increase, over half was an increase in production inventory. Our team continues to work closely with our suppliers to mitigate supply chain impacts on production. We experienced rising material and freight costs during the quarter.”

He stressed the impacts:

“However, supply chain challenges may impact our ability to fully meet customer demand. In Construction Industries, we remain positive as we've seen end-market demand increase in most regions. In North America, residential construction continues to be a strong driver of industry growth. Non-residential is also improving, although activity remains below pre -pandemic levels. We're hopeful that Congress passes the Infrastructure Investment and Jobs Act, which could boost customer confidence and help support future demand. In China, we continue to expect the industry for excavators above 10 tons to be about flat in 2021 with declines in the second half of the year offsetting growth in the first half. Outside of China, we expect the Asia Pacific region to remain strong in the fourth quarter, backed by strong housing activity, favorable commodity prices, and the benefits of government stimulus. In EAME, fundamentals remain positive. Stimulus actions continue and construction confidence improves. We expect the industry in Latin America to be supported by construction activity and the continued mining recovery. Turning to Resource Industries, elevated commodity prices and strong minor CapEx expectations support continued improvement in customer demand. The number of markets with parked trucks in the field remains low and utilization has been improving. We also remain optimistic in heavy construction and quarry and aggregates, where we continue to see improving demand. Finally, in Energy and Transportation, we expect demand to improve during the fourth quarter compared to last year. In Oil & Gas, we expect services growth, and a focus on sustainability to drive demand for new equipment in the form of repowers. We expect that to be balanced though by continued capital discipline by our oil and gas customers. Recip power generation is expected to remain strong with strength in data centers. Industrial is expected to see continued strength across all applications. A modest increase is anticipated in Transportation with improvement in rail, primarily in services and international locomotives.”

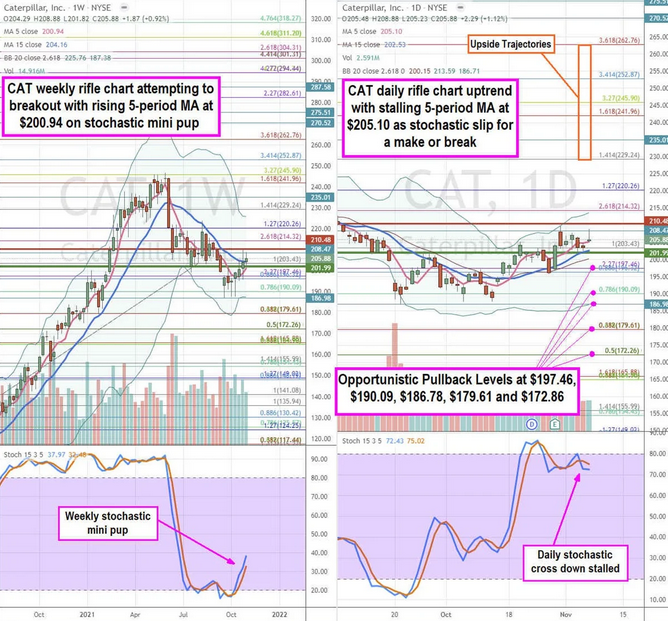

CAT Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the price action playing field for CAT shares. The weekly rifle chart peaked at the $245.90 Fibonacci (fib) level. The weekly 5 period moving average (MA) is slowly rising at $200.94 towards a crossover at the 15-period MA at $204.16. The weekly stochastic mini pup is rising towards the 40-band. The weekly market structure low (MSL) buy triggered on the breakout above $201.99. The weekly upper Bollinger Bands (BBs) sit at $225.76. The daily rifle chart uptrend is stalling at the 5-period MA at $205.10 and rising 15-period MA at $202.53. The daily stochastic crossed down but stalled as the daily sets up the make or break. The upside BBs sit near the $214.32 fib and lower BBs at the $186.96 daily lower BBs. Prudent investors can watch for opportunistic pullback levels at the $197.46 fib, $190.09 fib, $186.78 fib, $179.61 fib, and the $172.86 fib level. The upside trajectories range from the $229.24 fib up towards the $262.76 fib.