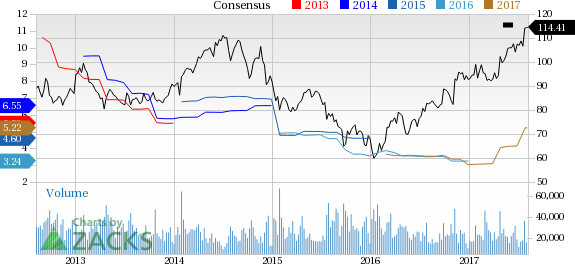

Caterpillar Inc.‘s (NYSE:CAT) shares attained a 52-week high of $115.25 during intraday trading on Aug 8, finally closing lower at $114.41. The company has delivered a one-year return of about 43%. Caterpillar has a market cap of $67.61 billion. Average volume of shares traded in the last three months was approximately 4.45 million.

What's Driving Caterpillar?

Caterpillar delivered another upbeat quarter with adjusted earnings per share of $1.49 in second-quarter 2017, logging a 37% improvement year over year and also outpacing the Zacks Consensus Estimate of $1.26. The better-than-expected results were driven by the company’s disciplined cost-control efforts. Revenues improved 9.6% year over year to $11.3 billion in the quarter, also surpassing the Zacks Consensus Estimate of $10.9 billion. Favorable price realization and higher sales volume, with most significant increase witnessed in Construction Industries owing to higher end-user demand for construction equipment led to the improvement.

At the end of second-quarter 2017, Caterpillar’s backlog was at $14.8 billion that improved by about $3 billion year over year driven by improvement across all segments, particularly in Construction and Resource Industries.

This follows a stellar first quarter wherein Caterpillar reported year-over-year improvement in both top and bottom lines for the first time in 10 quarters. Consequently, the company has outperformed the industry on a year-to-date basis. Shares have gained 26.3% while the industry registered an increase of 24.2%.

Owing to the upbeat first-half performance, improved order activity and disciplined cost control, Caterpillar also hiked revenue guidance during second quarter conference call to the range of $42–$44 billion from the prior range of $38–$41 billion. The company now projects earnings per share of $5.00 per share compared with previous guidance of $3.75 per share. In 2017, restructuring costs will be around $1.2 billion. The mid-point of the revenue guidance and earnings per share guidance reflect a year-over-year growth of 12% and 46% respectively.

Quoting activity remains promising in many of Caterpillar’s markets and retail sales are trending positive for both machines and Energy & Transportation In construction, Asia Pacific is showing promise while leading indicators of U.S. construction signal robust conditions ahead. The company’s efforts to reduce costs will continue to boost margins. Going forward, the company is expected to benefit from President Trump’s plans of big spending in infrastructure as it is anticipated to play a major role in the national infrastructure plan.

Caterpillar, Inc. Price and Consensus

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Original post

Zacks Investment Research