Caterpillar Inc. (NYSE:CAT) has finally entered into its previously announced five-year strategic alliance with leading equipment distributor, Ritchie Bros. Auctioneers Incorporated (NYSE:RBA) . This alliance will ensure that more used-equipment buyers will have access to Caterpillar’s leading products, digital offerings and customer support through the Cat dealer network. This is a step in Caterpillar’s digital strategy of focusing on connecting more products in its customers’ fleets and will also help improve their productivity, increase safety as well as drive sustainability.

The alliance had been announced in August last year but was subject to Ritchie Bros.’ acquisition of IronPlanet, a leading online marketplace for heavy equipment and other durable assets. The acquisition was duly completed by Ritchie Bros. in May 2017. This move accelerates Ritchie Bros.' strategy of becoming a one-stop, multichannel company enabling customers to buy, sell or list equipment according to the place or time of their choice – both onsite and online.

Per the Caterpillar-Ritchie Bros alliance, the latter will become Caterpillar's preferred global partner for live onsite and online auctions for used Caterpillar equipment and also complement Caterpillar's existing dealer channels. The alliance will strengthen Ritchie Bros.’ association with Caterpillar's global independent dealers by providing them with better and continued access to a global auction marketplace for their used equipment. Caterpillar’s dealers will have access to proprietary auction platforms, software and other value-added services. This will aid improve the exchange of information and services between customers, dealers and suppliers. This alliance will also provide Caterpillar's used-equipment buyers access to its leading products, digital offerings and world-class customer support through the Cat dealer network. Moreover, the deal will allow independent dealers and their respective customers to continue with an accelerated delivery of Caterpillar's Internet of Things (IoT) connectivity offerings, to improve their fleet utilization.

Caterpillar, Inc. Price

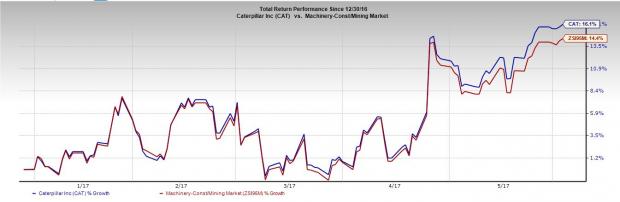

Year-to-date, the Caterpillar stock has outperformed the Zacks Categorized Machinery – Construction/Mining industry. The company has delivered a return of 16.1%, while the industry gained 14.4%.

Caterpillar currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks worth considering in the same sector include AGCO Corporation (NYSE:AGCO) and Parker-Hannifin Corporation (NYSE:PH) . Both the stocks flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has an average positive earnings surprise of 40.39% in the trailing four quarters. Parker-Hannifin has an average positive earnings surprise of 14.94% in the last four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Ritchie Bros. Auctioneers Incorporated (RBA): Free Stock Analysis Report

Original post