Caterpillar Inc.‘s (NYSE:) shares attained a 52-week high of $115.86 during intraday trading on Aug 22, finally closing a tad lower at $114.82. The company has delivered a one-year return of about 43%. Caterpillar has a market cap of $68.45 billion. Average volume of shares traded in the last three months was approximately 4.09 million.

What's Driving Caterpillar?

The new 52-week high comes on the heels of the company’s announcement of a 12% rise in sales in July - its best performance so far in 2017. This can be attributed to the continued improvement in Asia Pacific (45% growth in July) and a turnaround performance in Resource Industries. It also witnessed improvement in all regions, another first this year. The Asia Pacific region has been a consistent performer for Caterpillar since it posted the first positive reading in August 2016.

Overall sales at Resource Industries were up 8%, a marked improvement from the decline suffered in the first half of the year. Sales in Construction Industries improved 13% year over year, the best reading so far this year, again led by Asia Pacific. The construction industry has now entered a more mature phase of expansion, and construction spending can be anticipated to witness moderate gains through 2017 and beyond.

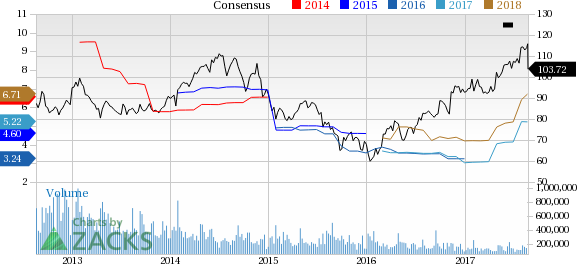

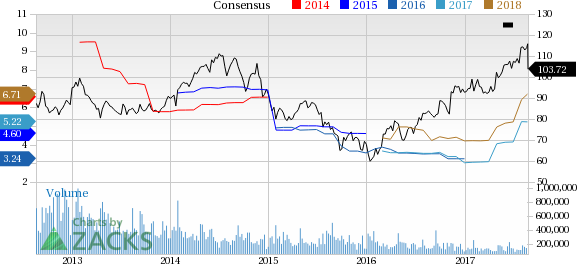

Caterpillar, Inc. Price and Consensus

Caterpillar, Inc. Price and Consensus | Caterpillar, Inc. Quote

In March, the company reported a recovery in sales with a 1% rise that put an end to its dismal 51-month long stretch of declining sales. Since then, monthly sales growth has remained in the positive territory. Caterpillar which been grappling with a weak mining industry, is finally showing signs of recovery this year owing to its incessant efforts to cut down costs.

The company delivered an upbeat second quarter with adjusted earnings per share improving 37% while revenues improved 9.6%. This build on the momentum set in the first quarter wherein Caterpillar reported year-over-year improvement in both top and bottom lines for the first time in 10 quarters. Consequently, the company has outperformed the industry on a year-to-date basis. Shares have gained 24.8% while the industry registered an increase of 13.3%.

Owing to the upbeat first-half performance, improved order activity and disciplined cost control, Caterpillar now guides 2017 revenues in the range of $42-$44 billion and earnings per share of $5.00. The mid-point of the revenue guidance and earnings per share guidance reflect a year-over-year growth of 12% and 46% respectively.

In construction, Asia Pacific will continue positive momentum owing to increased infrastructure and residential investment in China. Leading indicators of U.S. construction signal robust conditions ahead. The company’s efforts to reduce costs will continue to boost margins. Going forward, the company is anticipated to benefit from President Trump’s plans of big spending in infrastructure as it is anticipated to play a major role in the national infrastructure plan.

Estimates for Caterpillar have also moved up in the past 30 days, reflecting the optimistic outlook of analysts. The earnings estimate for fiscal 2017 has gone up 21% while that of fiscal 2018 has moved up 24%. The Zacks Consensus Estimate for fiscal 2017 is at $5.22, reflecting a projected 52.66% year-over-year growth and the same for fiscal 2018 is at $6.71, a 28.50% year-over-year growth.

Caterpillar currently sports a Zacks Rank #1 (Strong Buy). The company has a long-term expected earnings growth of 9.50%.

Some other top-ranked stocks in the same sector include Terex Corporation (NYSE:) , AGCO Corporation (NYSE:) and Apogee Enterprises, Inc. (NASDAQ:) . While Terex and AGCO flaunt the same rank as Caterpillar, Apogee carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Terex has expected long-term growth rate of 19.67%.

AGCO has expected long-term growth rate of 13.51%.

Apogee has expected long-term growth rate of 12.50%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis ReportTerex Corporation (TEX): Free Stock Analysis ReportCaterpillar, Inc. (CAT): Free Stock Analysis ReportAGCO Corporation (AGCO): Free Stock Analysis ReportOriginal postZacks Investment Research