We issued an updated report on Catalyst Pharmaceuticals, Inc. (NASDAQ:CPRX) on Sep 15.

Catalyst Pharma is a development-stage biopharmaceutical company focused on the development and commercialization of therapies targeting rare neurological diseases and disorders such as Lambert-Eaton myasthenic syndrome (LEMS), epilepsy (initially infantile spasms) and Tourette syndrome.

At present, this Coral Gables, FL-based company has two candidates under development, Firdapse and CPP-115.

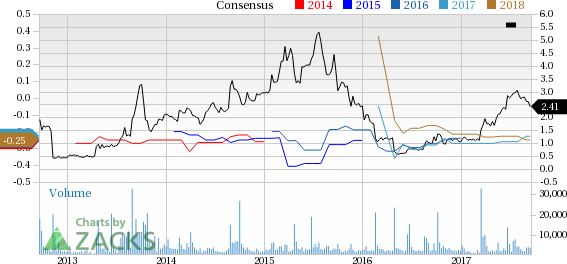

Catalyst Pharma’s shares have outperformed the industry year to date. The stock has surged 129.6% compared with the industry’s gain of 2.9% in the same time frame.

The company expects to report top-line results from its second phase III study of Firdapse for the treatment of Lambert-Eaton myasthenic syndrome (LEMS) in the second half of 2017 and resubmit a new drug application (NDA) before the end of 2017. Earlier in 2016, it received a refusal to file letter from the FDA in connection with the NDA for Firdapse.

Notably, the agency determined that the company’s NDA was insufficient after a preliminary review. Consequently, Catalyst Pharma was required to conduct additional studies as per the agency’s requirements, in addition to the results of its previously submitted phase III data.

In October 2016, it reached an agreement with the FDA under a Special Protocol Assessment (SPA) for the protocol design, clinical endpoints, and statistical analysis approach to be taken in its second phase III study evaluating Firdapse.

Meanwhile, the company is working on developing Firdapse for additional indications. In February 2016, Catalyst initiated an investigator-sponsored phase II/III study on Firdapse for the symptomatic treatment of MuSK-antibody positive MG. In March 2017, the company reported top-line data from the phase II/III trial.

The potential approval of Firdapse, along with its label expansion, will help in generating revenues for the company.

Additionally, Catalyst Pharma is exploring the possibility of developing CPP-115 (a GABA aminotransferase inhibitor) for the treatment of epilepsy (initially infantile spasms) and the treatment of other selected neurological indications such as complex partial seizures and Tourette’s disorder.

However, the market for epilepsy treatments is highly competitive and crowded given the presence of products like Pfizer’s (NYSE:PFE) Neurontin and Lyrica, Johnson & Johnson’s (NYSE:JNJ) Topamax, and Novartis’ (NYSE:NVS) Trileptal.

Zacks Rank

Catalyst Pharma currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Pfizer, Inc. (PFE): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Catalyst Pharmaceuticals, Inc. (CPRX): Free Stock Analysis Report

Original post

Zacks Investment Research