The Case-Shiller home price data for December were released yesterday, showing another broad decline in the 10-city and 20-city composite indices to new lows for the secular downtrend from the bubble peak last decade.

Data through December 2011 … showed that all three headline composites ended 2011 at new index lows. The national composite fell by 3.8% during the fourth quarter of 2011 and was down 4.0% versus the fourth quarter of 2010. Both the 10- and 20-City Composites fell by 1.1`% in December over November, and posted annual returns of -3.9% and -4.0% versus December 2010, respectively. These are worse than the -3.8% respective annual rates both reported for November. With these latest data, all three composites are at their lowest levels since the housing crisis began in mid-2006. “In terms of prices, the housing market ended 2011 on a very disappointing note,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “With this month’s report we saw all three composite hit new record lows.”

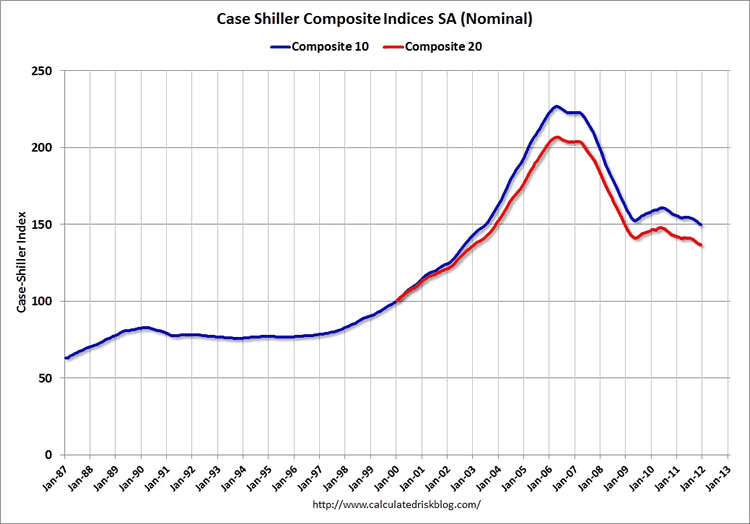

The following graph from Calculated Risk displays the long-term view of the 10-city and 20-city composite indices.

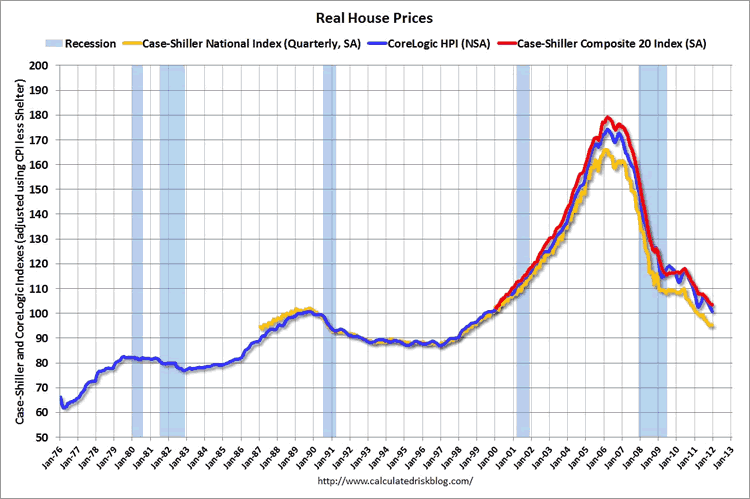

As expected, the current phase of the secular downtrend following the implosion of the most speculative bubble in residential real estate history continues to decline at a measured rate. In real terms, prices continue to trend lower as shown on the following graph of the inflation-adjusted versions of the CoreLogic HPI, the Case-Shiller 20-city composite and the Case-Shiller national index.

Overall, residential real estate values will remain under pressure as the massive oversupply introduced during the speculative frenzy of the bubble years continues to be slowly integrated into the market.

Leading data in the housing market suggest that a cyclical bottom may develop this year, but a strong rebound in prices is highly unlikely. Once a sustainable long-term bottom is formed, home values will likely consolidate for many years before the next structural advance develops.

Data through December 2011 … showed that all three headline composites ended 2011 at new index lows. The national composite fell by 3.8% during the fourth quarter of 2011 and was down 4.0% versus the fourth quarter of 2010. Both the 10- and 20-City Composites fell by 1.1`% in December over November, and posted annual returns of -3.9% and -4.0% versus December 2010, respectively. These are worse than the -3.8% respective annual rates both reported for November. With these latest data, all three composites are at their lowest levels since the housing crisis began in mid-2006. “In terms of prices, the housing market ended 2011 on a very disappointing note,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “With this month’s report we saw all three composite hit new record lows.”

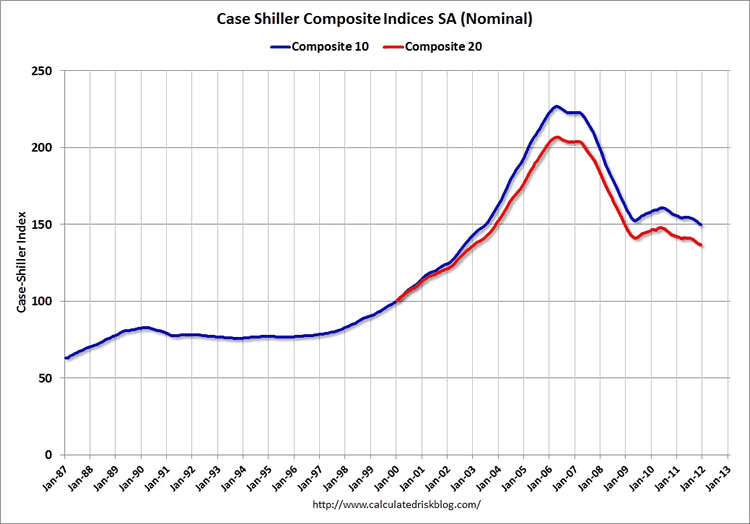

The following graph from Calculated Risk displays the long-term view of the 10-city and 20-city composite indices.

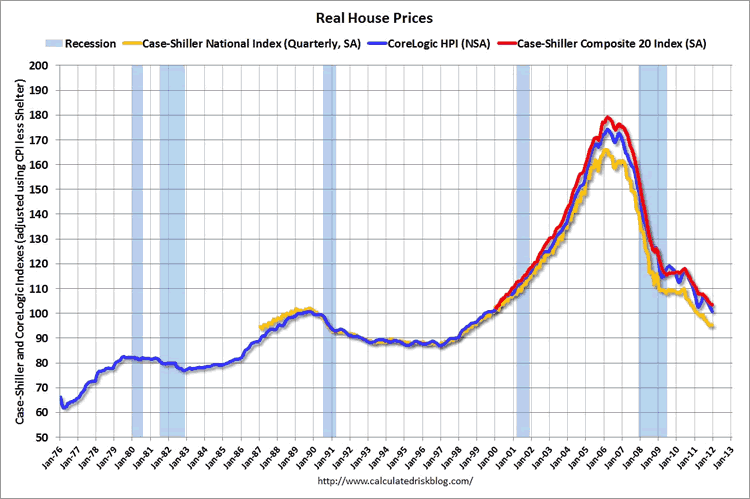

As expected, the current phase of the secular downtrend following the implosion of the most speculative bubble in residential real estate history continues to decline at a measured rate. In real terms, prices continue to trend lower as shown on the following graph of the inflation-adjusted versions of the CoreLogic HPI, the Case-Shiller 20-city composite and the Case-Shiller national index.

Overall, residential real estate values will remain under pressure as the massive oversupply introduced during the speculative frenzy of the bubble years continues to be slowly integrated into the market.

Leading data in the housing market suggest that a cyclical bottom may develop this year, but a strong rebound in prices is highly unlikely. Once a sustainable long-term bottom is formed, home values will likely consolidate for many years before the next structural advance develops.