- The past two days have marked a significant shift in rhetoric from ECB members: on Wednesday, Nowotny made the case for granting ESM a banking license, and Thursday, Draghi said that it would be within the mandate of the central bank to act towards elevated sovereign borrowing costs if these distort the monetary transmission mechanism. The latter sparked optimism that the ECB could revive its slumbering Securities Market Programme and start buying peripheral sovereign bonds again. The comments have been aiding sentiment in both the US and Asian sessions overnight. Adding to the eurozone cheer yesterday was the announcement from the Irish debt office that Ireland is returning to bond markets.

- Draghi’s comments on impact lifted EUR/USD above 1.2300 and the pair is only slightly off that level this morning, and sent Spanish and Italian rates markedly lower.US and Asian equities alike also reacted positively despite dismal Facebook earnings. However, US bond markets were seemingly less convinced that Draghi was hinting at a change in ECB attitude towards the euro debt crisis and yields actually ended the day a little higher across the curve. The ECB comments in recent days make the coming week’s ECB meeting all the more important as this could provide more details on what concrete measures the ECB is contemplating.

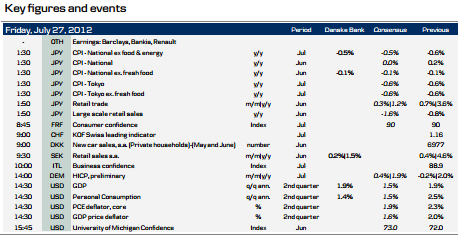

- Japanese data released overnight painted a weaker picture of the economy than forecast: CPI declined more than expected and retail sales were much softer in June than predicted by analysts. Japan is suffering from weaker export prospects due to the stronger yen as the boost to growth from earthquake reconstruction is now fading.

- Focus today will undoubtedly be on US Q2 GDP figures: we look for growth to be unchanged at 1.9% q/q (AR) from Q1 versus consensus of 1.5%. We expect GDP growth to print below trend until Q2 13 leaving annual growth at 2.1% in 2012 and 2.2% in 2013. A modest increase in employment growth from the current level should push the unemployment rate marginally down to 8% by the end of this year. A weaker-than-expected GDP number today would clearly add to fears of a prolonged global slump but should at the same time revive hopes of more Fed easing; hence this would not necessarily be a one-way street for risk appetite.

- Yesterday’s data out of Sweden on June trade and unemployment data added to our conviction that Q2 GDP next week will be stronger than anticipated by the Riksbank. This morning June retail sales are due for release and we expect growth to drop to 1.5 % y/y. That said, yesterday’s business and confidence indicators were quite downbeat, suggesting prospects for the Swedish economy are slowly deteriorating. In our view, Monday’s GDP data will likely take out some of the front end of the current money market curve, while the confidence numbers suggest adding to it further out. That is, we will likely see rate cut expectations being pushed out in time.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

This publication is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S.

Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”.

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.