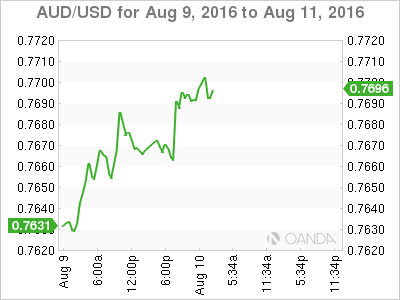

Australian Dollar – Carry is King

Higher-yield currencies are leading the charge, stoked by booming risk appetite. The market is buying into the underlying premise that the US economy is robust, but not churning at sufficient levels to warrant any immediate policy response.

This argument was reinforced by a less optimistic US Non-Farm Productivity print, which unexpectedly fell in the second quarter, tempering the markets elation from last Friday’s impressive Non-Farm Payrolls print.

Now that the Fed appears to be on hold and that other global central banks are in motion, along with a relative calm in the RMB complex, the Australian dollar (AUD) is trading encouragingly on the back of buoyant global equity market fervor.

Traders are focused on external factors to drive forward the market for AUD. They brushed aside calls for an “unconventional monetary policy” by in-house economists at the National Bank of Australia after the recent NAB survey missed expectations.

Currently, the price action is doing the talking, as the AUD finds huge demand on any dips and should remain so in this low-cost cash environment.

Adding to the dollar's appeal was today’s WestPac Consumer Confidence Index, which surprised the market, coming in 101 vs. 99.1 prior, with month on month figures surging +2% vs. -3% prior, the first rise in 3 months.

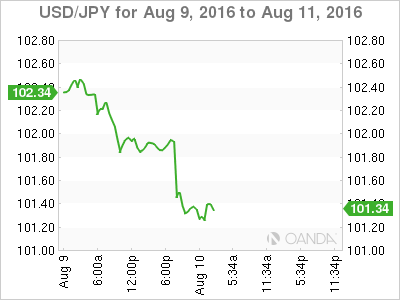

USD/JPY – Seasonality Factors in Play

Investors have been buying US bonds overnight, which is likely the most persuasive argument behind a ‘Fed on hold’ scenario. 10-Year Treasury yields slid towards the 1.54 % level as USD/JPY moved south of ¥102.00. This was unsurprising as the market is gearing up for Friday’s highly anticipated US Retail Sales data.

Much of the market NFP froth has evaporated as recent Fed-speak has erred on the side of caution rather than exuberance from last week employment data.

Perhaps there are some seasonality factors at play which are limiting USD/JPY upside. We are entering Japan’s Obon Holiday week, which means that Japanese corporations will be on holiday until Aug 16, and liquidity usually runs low in USD/JPY this week.

Domestic exporters have begun layering top side market orders, which would likely add as a short-term ceiling for USD/JPY. There is also talk about repatriation flows from a US Treasury coupon redemption on August 15, which from a ‘real money’ perspective, has traders wary about pressing the top side ahead of Friday’s US data.

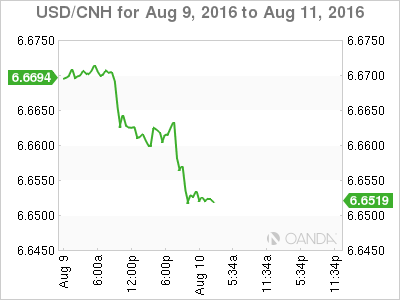

Yuan – Holiday Calm

The markets are running quietly, with volumes primarily driven by real money and speculation position squaring, ahead of the summer holiday season.

China’s inflation index is much in line and has failed to attract much attention from RMB traders. The relatively tepid prints play into the carry, and there is a risk-on sentiment in the commodity currency related basket, especially for the Australian dollar.

But overall , I anticipate range trade to dominate price actions

USDASIA – Goldilocks Principle

ASIA FX continues to remain supported, propelled by the Goldilocks Principle that the US economy is healthy, but not buoyant enough for a Fed policy response. Clearly, central bank policy accommodation and expectations that interest rates will remain lower for longer is the primary driver of regional sentiment. The chase for yield continues.

In Malaysia, local traders are warming up to this week’s bounce in energy prices. When combined with the positive outlook for the domestic equity markets, the MYR should remain supported.

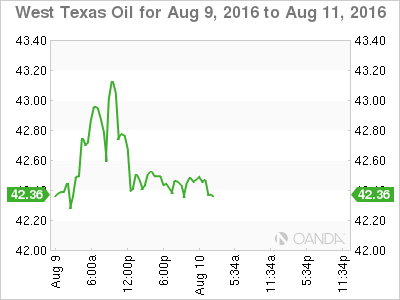

Oil – Many Skeptics

In a case of Deja Vu, oil prices have made a decent bounce off the lows earlier this month, and short covering has taken effect on the heels of more OPEC rumours regarding production freezes.

Underlying the July price breakdown is a fundamental issue of supply and demand, of which rising crude and gasoline inventories are key factors. Inventory concerns have not magically disappeared so that we could be setting up for another classic buy-the-rumour, sell-the-fact scenario.

On cue, the API has reported the biggest crude oil build in 3 months, after reporting a significant inventory build of 2.09 million barrels. We will have to wait and see how this OPEC story line plays out.