Upstream energy company Carrizo Oil & Gas, Inc. (NASDAQ:CRZO) recently signed a purchase and sale agreement with ExL Petroleum Management, LLC - a portfolio company of private equity and venture capital firm, Quantum Energy Partners - to acquire Delaware Basin assets for $648 million in cash and potential contingent payments.

The acquisition of the assets is in line with the company's plan to increase its core position in Delaware Basin, one of the highest-return plays in North America.

Deal Details

Carrizo will receive 23,656 gross (16,488 net) acres after the acquisition, which is expected to close in mid-August, in Reeves and Ward counties. Net production from the asset is around 8,000 barrels of oil equivalent per day (BOE/d), of which 48% is oil. The company will get 11 operational wells and seven prospective wells. Although ExL is presently operating with four rigs in the area, Carrizo plans to start operations with three rigs after the acquisition.

The contingent payment requires Carrizo to pay ExL $50 million per year (maximum of $125 million) if U.S. oil averages more than $50 per barrel in any calendar year during period 2018-2021.

Financing Plan

The multiple-source financing plan for the deal consists of preferred stock offering and potential capital market transactions. The company will issue $250 million of redeemable preferred stock at 8.875%, while offloading its non-core properties (like Appalachian assets) to fund the deal. Carrizo expects to receive at least $300 million from its non-core divestitures. We would like to inform investors that Carrizo has also ceded GSO Capital Partners LP warrants to buy 2.75 million shares of its common stock at $16.08 per share, which have a 10-year term.

About the Company

Carrizo is a Houston-based energy company actively engaged in the exploration, development, exploitation and production of oil and natural gas. It primarily operates in proven trends in the Barnett Shale area in North Texas and along the Texas and Louisiana onshore Gulf Coast regions. Carrizo controls significant prospective acreage blocks and utilizes advanced three-D seismic techniques to identify potential oil and gas reserves and drilling opportunities.

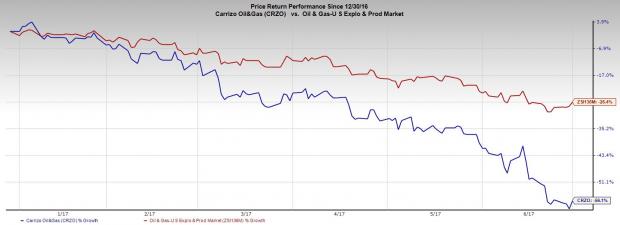

Price Performance

Carrizo shares have suffered this year, as have shares of all oil-related companies, to reflect the commodity's price slide and uneven outlook. In particular, Carrizo – which falling under the Zacks categorized Oil and Gas - United States - Exploration and Productionindustry – has seen its shares drop 56.1% in the year-to-date period compared with the broader industry’s decrease of 26.4%.

Zacks Rank and Stocks to Consider

Carrizo presently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the oil and energy sector include Enbridge Energy, L.P. (NYSE:EEP) , Canadian Natural Resources Limited (TO:CNQ) and Delek US Holdings, Inc. (NYSE:DK) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enbridge’s sales for the second quarter of 2017 are expected to increase 13.2% year over year. The company delivered a positive earnings surprise of 128.6% in the first quarter of 2017.

Canadian Natural Resources’ sales for the second quarter of 2017 are expected to increase 26.9% year over year. The company pulled off a positive earnings surprise of 30.8% in the first quarter of 2017.

Delek US Holdings’ sales for 2017 are expected to increase 71.3% year over year. The company came up with a positive average four-quarter earnings surprise of 60.7%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Carrizo Oil & Gas, Inc. (CRZO): Free Stock Analysis Report

Original post

Zacks Investment Research