As flagged at the interim stage, group profits dipped during FY17 as a result of weak demand for feed blocks in the US and a major contract delay affecting the UK manufacturing activity. Demand for feed blocks in the US began to pick up in the second half and the major contract was finally signed in July, underpinning a recovery in FY18. Despite these short-term setbacks, management continued to invest for the medium-term, opening up the US nuclear market through the acquisition of NuVision and constructing a new feed-block plant to serve the eastern and southern US. We raise our estimates slightly to reflect a continuation of the favourable environment in UK agriculture and upgrade our indicative DCF valuation from 163p/share to 167p/share.

FY17 impacted by external factors

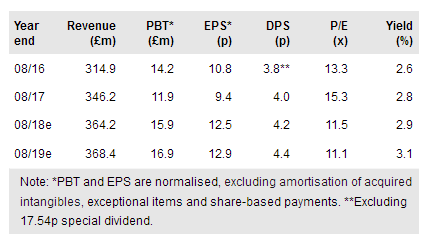

Group FY17 revenues rose 10% year-on-year to £346.2m, ahead of our £332.2m estimate, reflecting higher commodity prices and higher volumes in the UK Agricultural businesses. Pre-exceptional PBT, which excludes share-based payments, dropped by 16.2% to £11.9m, in line with our estimates. Growth in the UK Agriculture and Remote Handling activities was offset by weak demand for feed blocks in the US, resulting from a surplus of beef cattle following extensive restocking, and a significant contract delay in the UK Manufacturing part of the Engineering division.

To read the entire report Please click on the pdf File Below: