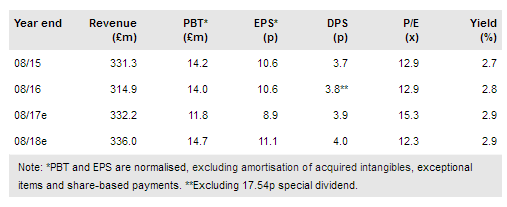

Carr’s Group PLC (LON:CARRC) notes that the continued recovery in UK agriculture, supported by improving farmer confidence, is offsetting weak demand in the US for feed blocks caused by a surplus of cattle following a period of restocking. Importantly, management is seeing the first signs of recovery in the US market. This, together with a strong order book for the remote handling activity and improved prospects for the UK Manufacturing activity, underpin our expectations of profit recovery next year. We leave our estimates and valuation unchanged.

Recovery in UK agriculture continues

Management’s expectations at the interim stage that the UK Agriculture sector would remain positive have proved correct. The improvement in farmgate milk prices has boosted farmer confidence, resulting in higher demand for feed, for other agricultural inputs and for farm machinery, which is particularly sensitive to farmer sentiment. US deadweight cattle prices have risen, giving management confidence of feed block demand returning during FY18. In parallel, the group is taking a pro-active approach to drive growth eg acquiring Cheshire-based feed merchant Mortimer Feeds in June, thus strengthening its presence in a key dairy region.

To read the entire report Please click on the pdf File Below: