Carr’s is achieving growth through product innovation and sustained investment in infrastructure. While it operates in fairly defensive markets, it has further reduced risk through diversification within each market, supported by a sequence of acquisitions. As a result it has expanded its geographic reach, with almost half of the group’s FY13 profit before tax attributable to international operations. Our sum-of-the-parts analysis indicates that the stock is undervalued at current levels.

Strategy delivers growth whatever the weather

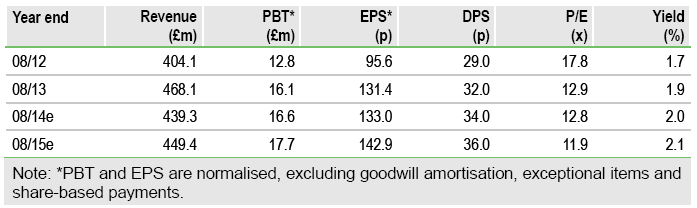

The new management is continuing to pursue the successful strategy that delivered a record £16.1m profit before tax in FY13, growth of 26%. The group benefited from market share gains for its innovative products, most notably its low-moisture feed blocks, AminoMax cattle feed enhancer and the sophisticated remote handling equipment manufactured by its Engineering division. Supportive weather conditions in both the UK and the US boosted demand for animal feeds, feed supplements and fuel oil. Crucially, even without a repeat of the favourable weather conditions, which accounted for £1.9m of the £3.3m FY13 profits growth, further profits growth is expected in FY14. This will be driven by continued market share gains in feed blocks and AminoMax, as new capacity in the US and UK comes on line to satisfy demand, and substantially better operating margins following £17m investment in the new flour mill in Kirkcaldy. The revenue swings primarily reflect the impact of fluctuating wheat prices on feed sales prices.

Scope for substantial growth in global markets

In our opinion, Carr’s stands out from other listed companies in the agricultural supply sector because its innovative feed supplement products address the global trend for farmers to adopt more sophisticated feed regimens. These are required in order to keep up with the growing demand for meat and dairy products driven by a rising global population and increased adoption of westernised diets. This gives scope for substantial growth in both the UK and international agricultural markets, decoupling Carr’s prospects from those of the fairly static UK feed market and reducing exposure to the vagaries of the British climate and EU farming policy.

Valuation: Potential for share price improvement

We adopt a sum-of-the-parts analysis for our valuation, as this approach reflects the diversity of activities in which Carr’s is engaged. This gives fair value at 1,985.3p/share, indicating potential for upwards movement in price towards this.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Carr's Milling Industries

Innovation, investment and internationalisation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.