The Bank of England struck an optimistic chord for the British economy yesterday as part of their Quarterly Inflation Report. Carney’s statement was bullish on growth, positive on wages and, most importantly, pointing to a recovery in inflation within their forecast period of the next two years.

Despite the falls in oil prices that have hammered inflation close to 0.0% in the UK, the Bank of England continues to believe that inflation will return to its 2% target. This is based on an assumption of no interest rate rises this year and only a small rise in rates through 2016. Simply put, the Bank of England wanted to emphasize that the recent slips in oil and food prices are transitory. They will, in the short term, provide a near term boost in growth – hence the upgrades to GDP expectations through 2016/17 – but will not preclude a normalization of interest rates higher.

That is not to say that the Bank of England is in a hiking mood. Governor Carney was at pains to emphasize that the outlook remains ‘balanced’ in the UK and that a deterioration in the economic and monetary conditions could lead to an increase in asset purchases (QE) or lower interest rates. This is a more of a cocking of the hat to the recent moves of some central banks – European, Danish, Swiss and, as of yesterday, Swedish – into negative interest rates in the past few months.

My central scenario for rates in the UK most definitely remains in place. I feel that the Bank of England will continue to lean on lower inflation expectations in the short term and broader economic uncertainty globally. In order to justify a hold of interest rates into 2016. Risks to this are that once the falls in petrol prices come out of the inflationary basket then we will see a sudden 1-1.1% increase in price levels and the Bank will feel the need to pull back on the reigns in Q4.

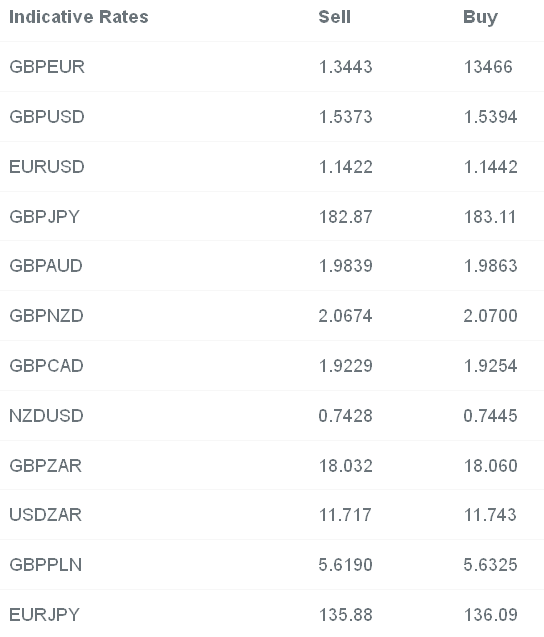

Sterling ran higher across the board on the announcement. GBP/USD pushed to a one month high above the 1.54 level whilst GBP/EUR broke to the highest level since January 2nd 2008. Comments by Carney that seemed to dismiss effects of contagion from a Greek exit on the UK banking system also helped GBP through the session.

Whisper it quietly but we are starting to see signs of a recovery within the eurozone. While French GDP only expanded by 0.1% in Q4 – compared to a 0.5% increase in the UK. We have seen both German and Dutch GDP smash expectations. The German economy grew by 0.7% in the last 3 months of 2014 whilst the Dutch economy expanded by 0.5%. Both will be enough to drag the eurozone GDP overall to 0.3% for Q4.

Overall it seems that domestic demand is starting to be seen in these economies – a natural by-product of the falls in oil prices – but investment is definitely the main laggard. It is not just the periphery in which we are seeing inward investment slow; French investment slipped by 0.4% to the year.

Italy however is expected to remain in recession through Q4 with analysts looking for a 0.1% decline in output. The overall eurozone growth number is due at 10am.