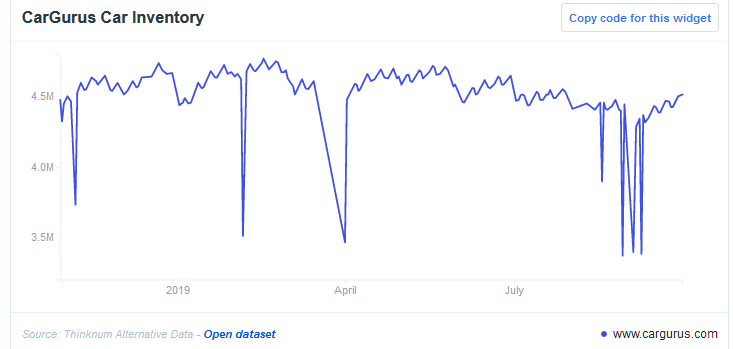

CarGurus (NASDAQ:CARG) might have seen its stock drop $25 since this time last year, but at least the data is pointed in the right direction. CarGurus is a place people can go to research cars, buy them, and contact sellers if they opt to go the used car route. And in terms of its total inventory and average car price, things are relatively stable, considering used car prices were at an all-time high this summer.

The average price of a car found on the website hasn't gone above or below $30,000.

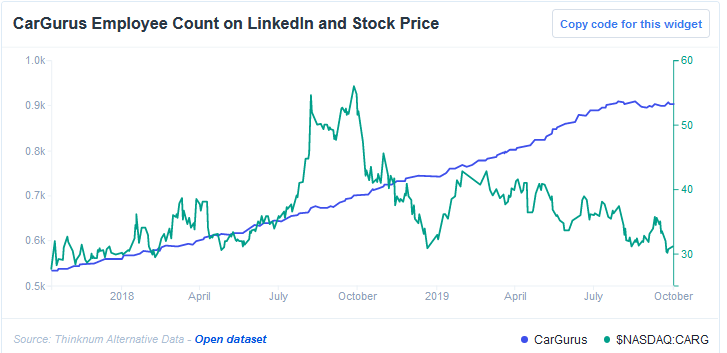

Here we overlay the stock and the total employee count, which tends to be a good indicator that they're looking to expand and grow the business, despite how the stock looks at any given moment.

In a year's time, they added 200+ new employees, and will crack 1,000 in 2020 if the trajectory maintains. Job listings are also on the rise, which reflects continuing growth ambition. Investors must be hoping that the stock will catch up.

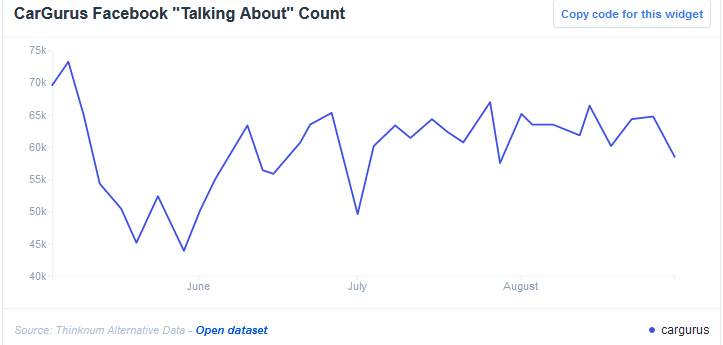

In 2016, the number of openings couldn't seem to crack 40. Now, they're flirting with 100 new openings all the time. The only quibble we have is that people talking about CarGurus on Facebook (NASDAQ:FB) is down slightly, 20% over the course of the summer. We blame the sky-high used car prices, as we've reported on before.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.