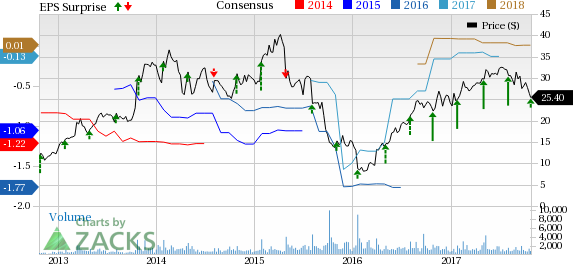

Cardiovascular Systems, Inc. (NASDAQ:CSII) reported adjusted loss per share of 6 cents in first-quarter fiscal 2018, flat with the year-ago quarter’s adjusted loss of 6 cents. The figure was narrower than the earlier provided guided range of loss per share of 9-7 cents. The figure compared favorably with the Zacks Consensus Estimate of a loss of 7 cents.

Results in Details

Cardiovascular Systems posted revenues of $49.7 million in the fiscal first quarter, marking a year-over-year decline of 0.2%. Also, the figure was lower than the guided range of $52.6-$53.6 million for the first quarter of fiscal 2018. The figure also missed the Zacks Consensus Estimate of $51 million.

Per management, procedure volumes in first-quarter fiscal 2018 were impacted by hurricanes. Moreover, the saline infusion pump recall during the quarter resulted in lower-than-estimated usage of the coronary device. These factors played significant roles which resulted in the revenue miss in the quarter.

To date, Cardiovascular Systems has sold over 340,000 devices to leading institutions in the United States. The company added 36 new peripheral accounts and 29 coronary accounts in the fiscal first quarter. Coronary device revenues declined 0.6% year over year to $11.5 million and peripheral device revenues inched down 0.2% to $38.2 million.

Margin

Gross margin in the reported quarter was 81.5%, up 48 basis points (bps) year over year.

Meanwhile, selling and administrative (SG&A) expenses contracted 2.6% to $35.9 million and research and development (R&D) expenses were up 18.2% to $6.3 million. Resultantly, adjusted operating expenses inched up 0.1% to $42.2 million. Per management, operating expenses were lower than the earlier provided guidance due to lower incentive compensation as a result of deterioration in financial performance. Operating loss was around $1.8 million, compared to the loss of $1.9 million in the year-ago quarter.

Financial position

The company exited the first quarter of fiscal 2018 with cash and cash equivalents of $104.7 million, compared with $107.9 million at the end of fiscal 2017.

Outlook

Cardiovascular Systems reaffirmed its fiscal 2018 revenue guidance at the range of $226-$233 million. The current Zacks Consensus Estimate for fiscal 2018 revenues is pegged at $228.25 million, which is within the company’s guided range.

The company expects revenues in the range of $52.5-$54 million for second-quarter fiscal 2018.The current Zacks Consensus Estimate is pegged at $55.79 million, above the company’s guided range.

Moreover, the company expects gross profit to account for 81% of revenues, while operating expenses are estimated at around $44.5 million for second-quarter fiscal 2018.

The company expects to incur net loss of $1.9-$1 million or loss per share of 6-3 cents in the second quarter of fiscal 2018.The current Zacks Consensus Estimate is pegged at a loss of a penny, above the company’s guided range.

Our Take

Cardiovascular Systems exited the first quarter fiscal 2018 on a mixed note. The decline in year-over-year revenues at Coronary device and peripheral device was disappointing. Fiscal first-quarter revenues declined on a year-over-year basis owing to the impact of hurricanes.

On a positive note, the reported loss in the quarter was narrower than the guided range of the company. Also, the expansion is gross margin was impressive. The company’s reaffirmed revenue guidance for fiscal 2018 buoys optimism. Moreover, the company is putting efforts in product innovation through R&D investments. During the quarter, the company released one-year data from its LIBERTY 360° clinical study in a late-breaking presentation at the 2017 Amputation Prevention Symposium (AMP) in Chicago. LIBERTY 360° showed that peripheral endovascular intervention can help prevent amputation for patients with peripheral artery disease.

Zacks Rank & Key Picks

Currently, Cardiovascular Systems has a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Abbott (NYSE:ABT) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed sports a Zacks Rank #1 (Strong Buy), while Abbott and Intuitive Surgical carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported EPS of 43 cents for the second quarter of fiscal 2018, up 79.2% from the year-ago quarter’s 24 cents. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter.

Abbott reported third-quarter 2017 adjusted earnings from continuing operations of 66 cents per share, up 11.9% year over year. Also, third-quarter worldwide sales came in at $6.83 billion, up 28.8% year over year.

Intuitive Surgical posted adjusted earnings of $2.77 per share in the third quarter of 2017, up 34.5% on a year-over-year basis. Also, revenues increased 18% year over year to $806.1 million.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Cardiovascular Systems, Inc. (CSII): Free Stock Analysis Report

Original post

Zacks Investment Research