It has been more than a month since the last earnings report for Cardiovascular Systems, Inc. (NASDAQ:CSII) . Shares have lost about 3.5% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Recent Earnings

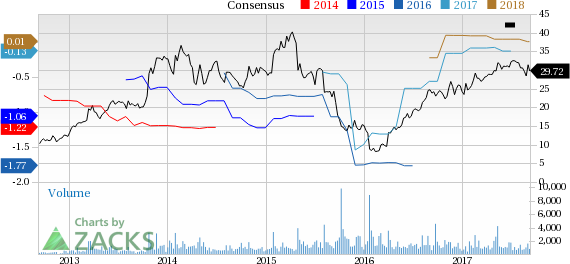

Cardiovascular Systems reported adjusted earnings per share of $0.2 in fourth-quarter fiscal 2017, reflecting massive improvement from the year-ago quarter’s adjusted loss of $0.15 a share. The quarter’s number compared favorably with the Zacks Consensus Estimate of a loss of $0.5.

The year-over-year improvement was primarily backed by revenue growth and lower operating expenses on account of the company’s cost realignment actions.

Full-year adjusted earnings came in at a loss of $0.6 per share, narrower than the year-ago loss of $1.72. Also, the loss figure was 53.8% narrower than the Zacks Consensus Estimate of a loss of $0.13.

The Numbers in Details

Cardiovascular Systems posted revenues of $52.9 million in the fiscal fourth quarter, marking a year-over-year increase of 9.2%. The figure also surpassed the Zacks Consensus Estimate of $52 million.

Fiscal 2017 registered revenues of $204.91 million, up 14.9% from the year-ago number. Also, revenues outpaced the Zacks Consensus Estimate of $204.03 million.

Per management, the company received approvals for the new orbital atherectomy devices that give physicians more tools to effectively and routinely treat patients suffering from coronary and peripheral artery disease. Also, the approval of Diamondback 360 Coronary Orbital Atherectomy System Micro Crown in Japan marks the company’s first international expansion, beginning in calendar year 2018.

To date, Cardiovascular Systems sold over 324,000 devices to leading institutions across the U.S. The company added 43 new peripheral accounts and 39 coronary accounts in the fiscal fourth quarter. Coronary device revenues improved 15.3% year over year to $13.2 million and peripheral device revenues rose 7.3% to $39.8 million.

Margin

Gross margin in the reported quarter was 81.7%, up 206 basis points (bps) year over year, primarily on account of a 9.2% rise in revenues.

Meanwhile, selling and administrative (SG&A) expenses contracted 4.4% to $35.9 million and research and development (R&D) expenses were up 4.9% to $6.3 million. The resultant adjusted operating expenses decreased 3.1% to $42.2 million, primarily exhibiting management’s cost realignment initiatives. Consequently, operating profit was around $1.0 million, improving from a loss of $4.9 million a year ago.

Financial position

The company exited the fourth quarter of fiscal 2017 with cash and cash equivalents of $107.9 million, compared with $103.1 million at the end of third-quarter fiscal 2017.

Outlook

Cardiovascular Systems issued its first-quarter fiscal 2018 and fiscal 2018 guidance. The company expects revenues in the range of $226–$233 million in fiscal 2018. The current Zacks Consensus Estimate for fiscal 2018 revenues is pegged at $231.40 million, which is within the company’s guidance.

The company also expects revenues in the range of $52.6–$53.6 million for the first quarter of fiscal 2018. The current Zacks Consensus Estimate is pegged at $54.11 million, slightly above the company’s guided range.

Moreover, the company expects gross profit to account for 81% of revenues, while operating expenses are estimated at around $45 million for first-quarter fiscal 2018.

The company expects to incur net loss of $2.8–$2.2 million or loss per share of $0.9–$0.7 in the first quarter fiscal 2018. The current Zacks Consensus Estimate is pegged at a breakeven, above the company’s guided range.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Cardiovascular Systems' stock has a great Growth Score of A, though it is lagging a lot on the momentum front with an C. Charting a somewhat similar path, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is more suitable for growth than momentum based on our styles scores.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Cardiovascular Systems, Inc. (CSII): Free Stock Analysis Report

Original post