- Pressure on leading cryptos continues, but promising sign visible

- Cardano: proof-of-stake crypto

- ADA has taken a dive

- Solana taking on Ethereum

- SOL underperformed Ethereum

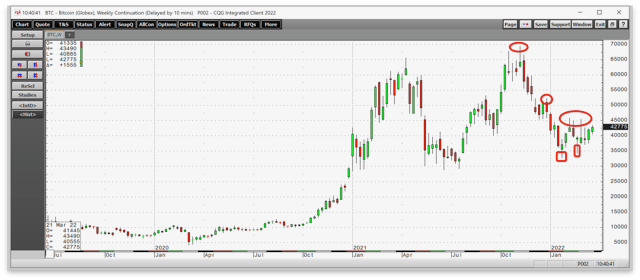

It would be an understatement to say it has been a bumpy ride in the cryptocurrency asset class. From a long-term perspective, the value of cryptos has exploded since Bitcoin quietly emerged on the scene at five cents per token. While the price action in digital currencies since November 2021 has been bearish, at the current $43,011 per Bitcoin at time of publication, the appreciation has been mind-blowing.

Bitcoin gave birth to Ethereum, and the two most highly valued tokens by market cap are the grandparents of a total 18,383 tokens, with the number of new entrants rising each day. Cryptocurrencies with the top 10 market caps in the asset class are worth more than $23.1 billion, which is not chump change.

Cardano (ADA) and Solana (SOL) are part of that elite class. Though ADA and SOL have corrected since the 2021 highs they continue to attract lots of attention.

Pressure On Leading Cryptos Continues, But Promising Signs Visible

Bitcoin and Ethereum prices continue to sit at levels closer to the Jan. 24 lows than the Nov. 10, 2021, highs.

Source: CQG

At $43,257 on Mar. 24, nearby Bitcoin futures were around $8,670 above the Jan. 23 low and more than $23,000 below the Nov. 10 high.

Source: CQG

At the $3,053.50 level on Mar. 24, nearby Ethereum futures were about $816.50 above the Jan. 24 low and $1,848 below the Nov. 10 high.

Meanwhile, Bitcoin and Ethereum prices have made lower highs and higher lows since the Jan. 24 low. The developing wedge pattern suggests that the leading cryptos are becoming tightly coiled springs that will break higher or lower, and sooner rather than later. Given the long-term trends, the odds continue to favor higher prices.

Bitcoin and Ethereum are the market leaders, but some of the highly capitalized followers will likely track them like obedient puppies.

Cardano: Proof-Of-Stake Crypto

Cardano is a public blockchain platform. It is open-source and decentralized, using a proof-of-stake protocol, requiring far less energy than the proof-of-work protocol. Cardano facilitates peer-to-peer transactions with its native cryptocurrency, ADA.

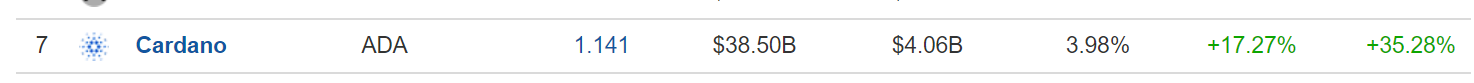

Cardano has been around since 2015, founded by Ethereum co-founder Charles Hoskinson. On Mar. 24, ADA is the seventh-leading cryptocurrency, with a market cap of more than $38.5 billion.

Source: Investing.com

ADA Has Taken A Dive

Cardano’s ADA began trading in October 2017 at 2.6 cents per token.

Source: CoinMarketCap

The chart highlights that ADA reached a high of $2.9682 in September 2021 before correcting. At $1.14 on Mar. 24, ADA has taken a serious dive but continues to have substantial market cap and liquidity, keeping it appealing for traders and investors.

Solana Taking On Ethereum

Solana is a public blockchain platform with smart contract functionality. Solana’s native cryptocurrency is SOL, and Solana claims to offer faster transaction times and lower costs than its main competitor, Ethereum.

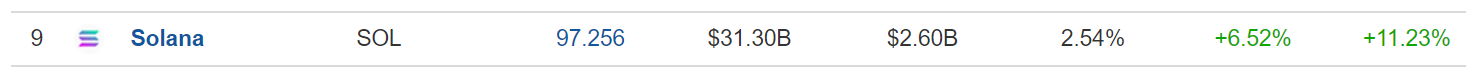

On Mar. 24, SOL was the ninth-leading cryptocurrency.

Source: Investing.com

At $97.32, SOL’s market cap stands at more than $31 billion.

SOL Underperforming Ethereum

SOL began trading in April 2020 at 78.0 cents per token.

Source: CoinMarketCap

It reached a high of $258.93 in November 2021. SOL’s price has dramatically corrected over the past months. Like ADA, it offers liquidity for traders and investors and is in the elite top 10 of the asset class.

ADA and SOL will likely follow Bitcoin and Ethereum when they break out of the current wedge patterns. This makes ADA and SOL attractive alternatives to the two top cryptos.

Nevertheless, investors and traders should only invest capital they are willing to lose in any cryptocurrency. A reward is always a function of risks, and the potential for incredible percentage gains goes hand in hand with the risk of a total loss.