Cardano saw many buyers around the $0.92 level, which could have triggered a bullish impulse.

Key Takeaways

- Cardano retraced by more than 26.5% in the past two weeks.

- Now, one technical indicator had suggested that a bullish impulse was underway.

- ADA must hold above $0.92 to be able to surge to $1.

At time of writing, Cardano appeared to be trading at a vital support level that had attracted many buyers. As long as it were to continue to hold, ADA had a chance of rebounding toward $1.

Cardano Hints At A Rebound

Cardano was holding above a significant demand zone while buy signals were starting to appear.

ADA had retraced by more than 26.5% over the past two weeks. The spike in profit-taking occurred after Cardano hit a high of $1.25 on Apr. 4, which saw prices decline to $0.92.

The Layer 1 platform, which was hoping to compete with the likes of Ethereum and Solana, was consolidating around this price point, signaling that a bullish impulse could have been underway.

The Tom DeMark (TD) Sequential indicator presented a buy signal on ADA’s daily chart. The bullish formation developed as a red nine candlestick, which was indicative of a one to four daily candlesticks upswing.

Rising upward pressure around the current price levels could help validate the optimistic outlook and push Cardano toward $1.

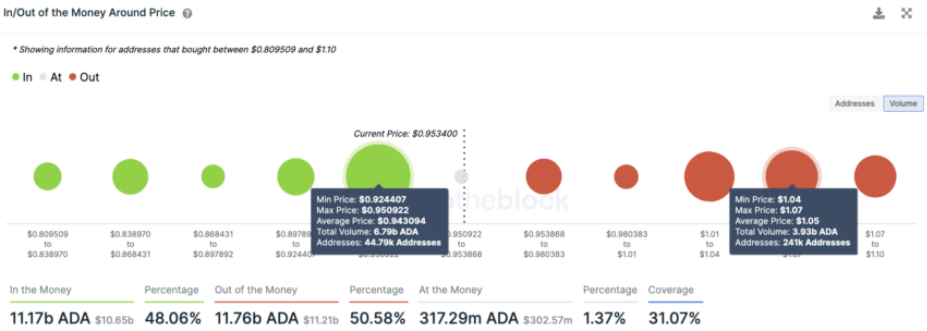

Transaction history shows that Cardano had built a strong foothold at around $0.92. Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, more than 44,790 addresses had previously purchased nearly 6.8 billion ADA around this price level.

The significant demand zone could prevent prices from dipping lower, helping validate the bullish thesis.

Nonetheless, a bullish impulse around the current price levels could meet stiff resistance at $1, where 241,000 addresses hold nearly 4 billion ADA.

A daily candlestick close above this hurdle could lead to higher highs.

It is worth noting that Cardano must avoid printing a daily close below $0.92 as this could lead to investors exiting their long positions.

If this support level is breached, ADA could experience a sell-off that sends it $0.80 or lower.