As Cardano approached the monthly close, it looked like bulls wanted to push prices higher.

Key Takeaways

- Cardano has endured a week-long consolidation period.

- The $2.98 resistance level has managed to keep ADA from resuming its uptrend.

- Transaction history shows stable support, favoring the bulls.

Cardano was up nearly 3% since the beginning of Tuesday's trading session as a new wave of volatility struck the cryptocurrency market. Regardless of the recent gains, one technical indicator showed that ADA had a barrier to overcome before it could make new highs.

Cardano Must Overcome Resistance

Cardano appeared to have entered a consolidation period after surging to a new all-time high of $2.98 on Aug. 23. Since then, it’s been making a series of higher lows, while the $2.98 resistance level has prevented it from advancing further.

Such market behavior seemingly formed an ascending triangle on ADA’s four-hour chart. A horizontal trendline can be drawn along with the swing highs and a rising trendline along with the swing lows.

An increase in buying pressure around the current price levels could have the strength to push Cardano beyond the overhead resistance at $2.98. In this eventuality, ADA could advance by nearly 16.3% to make a new all-time high of $3.43.

This target is found by measuring the distance between the two highest points of the triangle and adding it to the breakout point.

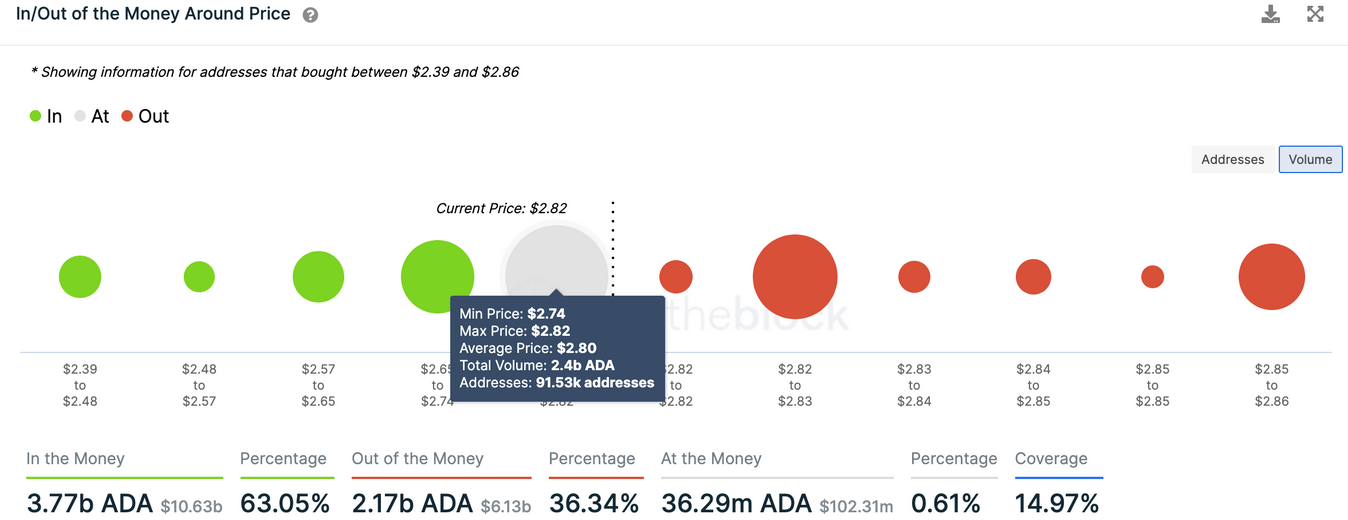

Transaction history shows that as long as the demand barrier that extends from $2.74 to $2.82 holds, the odds will favor the bulls. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows no significant supply barrier ahead of Cardano that will prevent it from achieving its upside potential.

Still, the third-largest crypto by market cap needs to continue trading above the $2.74 to $2.82 range to prevent 91,500 addresses from selling the 2.4 billion ADA they acquired around this price level.

Breaking below this crucial demand barrier may encourage investors to exit their positions to avoid seeing their investments go “Out of the Money.” A sell-off could instead lead to a 16.3% correction that pushes Cardano towards $2.40.