As flagged at the AGM in September, performance at Carclo’s Technical Plastics division (CTP) was held back by key new programmes slipping from H118 to H218 as well as some operational issues, which have been largely resolved. This was balanced by outperformance in the LED Technologies division (LED), where the level of design, development and tooling activity was ahead of expectations. Management anticipates that full year trading will be in line with expectations, so we leave our estimates broadly unchanged.

LED outperforms while CTP affected by H118 one-offs

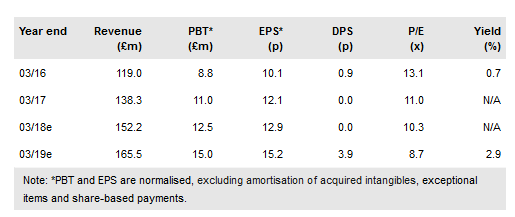

Group revenues grew by 14% (£8.9m) year-on-year during H118 to £72.2m. This was the result of a combination of strong (24%) growth in the LED Technologies division, c £2.6m from the PTD acquisition and £2.2m from favourable currency movements. Pre-exceptional PBT decreased by 6% (£0.3m) to £4.6m as an increase in LED EBIT was offset by decreases in the other two divisions. EPS (adjusted for exceptional items) decreased more quickly, by 20% to 4.5p, because of the dilutive impact of the placing in October 2016.

To read the entire report Please click on the pdf File Below: