The stock just came up on a real-time custom scan. This one hunts for calendar spreads between the front two months.

Custom Scan Details

Stock Price GTE $5

Sigma1 - Sigma2 GTE 8

Average Option Volume GTE 1,000

Industry isNot Bio-tech

Days After Earnings GTE 5 LTE 70

Sigma1, Sigma2 GTE 1

The goal with this scan is to identify back months that are cheaper than the front by at least 8 vol points. I'm also looking for a reasonable amount of liquidity in the options (thus the minimum average option volume), want to avoid bio-techs (and their crazy vol) and make sure I'm not selling elevated front month vol simply because earnings are approaching.

The news I see for Carbo Ceramics (CRR) - is a lawsuit -- but other than that, nothing really. Here's a quick snippet covering the legal news:

"Holzer Holzer & Fistel, LLC is investigating potential violations of the federal securities laws by Carbo Ceramics Inc. (“Carbo Ceramics” or the “Company”) (NYSE: CRR - News). The investigation focuses on whether a series of statements made between October 27, 2011 and January 26, 2012, inclusive, regarding Carbo Ceramics’ business, its prospects and its operations were materially false and misleading at the time they were made. Specifically, the investigation seeks to determine, among other things, whether Carbo Ceramics knew but failed to timely disclose that it was experiencing a decline in proppant sales in the Haynesville region." --

Source: BusniessWire via Yahoo! Finance -- Holzer Holzer & Fistel, LLC Announces Investigation into Carbo Ceramics Inc.

That lawsuit news makes it seem like the company just released some poor sales figures and the stock reaction kinda echoes that hypothesis -- call it confirming circumstantial evidence. Let's turn to the Skew Tab.

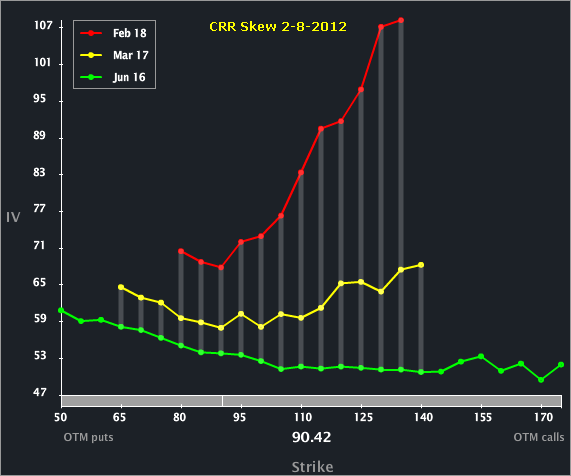

We can see the front three months show a monotonic increase in vol from back to front. Even more pronounced is the upside skew difference -- the Feb options show higher vol by strike as we move to further OTM calls (higher strikes), which is the opposite of "normal" skew. To read about normal skew and why it exists, you can read this post: Understanding Option Skew -- What it is and Why it Exists

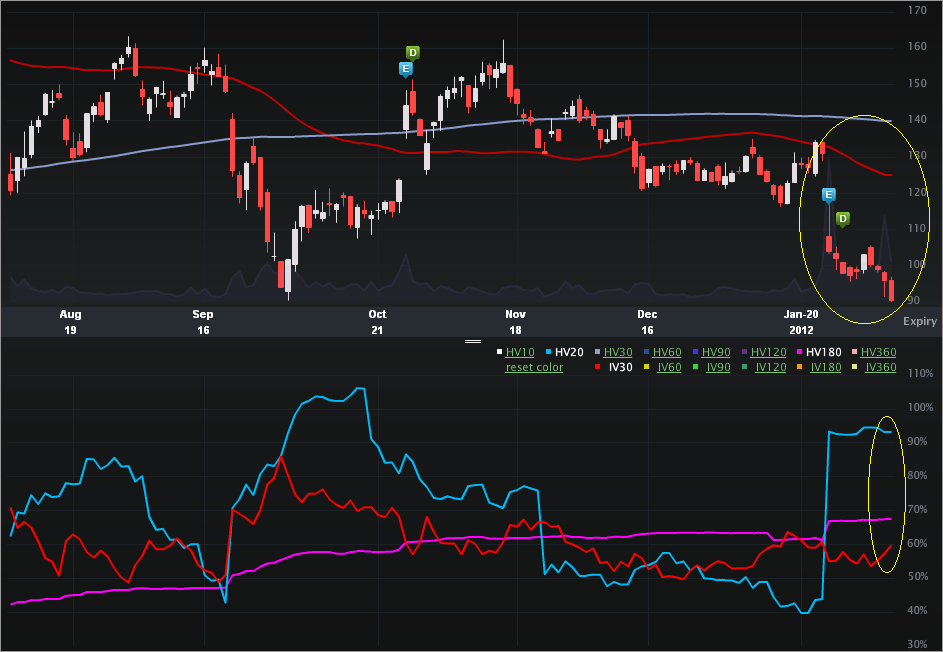

Now we can turn to the Charts Tab (below). The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

The stock gap down of late is pretty impressive. It started with the earnings report and has continued into today. On 1-25-2012 the stock was trading $131.03. As of today (about two weeks later), the stock is down 31%. It is a bit of quandary as to why the vol continues to stay relatively tame. The 52 wk range in IV30™ is [32.62%, 85.93%], so the current level is the 52nd percentile (annual). That's very middle of the road and still below the long-term historical realized vol... The current comps are:

IV30™: 60.17%

HV20™: 93.07%

HV180™: 67.39%

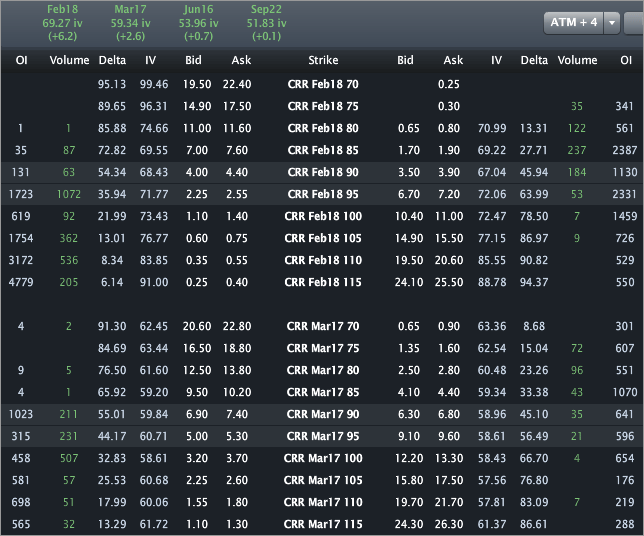

Finally, let's look to the Options Tab (below).

We can see Feb vol is priced to 69.27% with Mar priced to 59.34%. The next earnings report for CRR should be in late Apr -- possibly after the Apr expiry cycle. The elevated front makes sense given how much this stock seems to move with no real end in sight for the downward trend. The question is, why is the back still priced below the historical realized vol? The option market reflects lessened risk moving forward.

This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Carbo Ceramics Calendar Spread Opens in Dropping Stock

Published 02/08/2012, 11:45 PM

Carbo Ceramics Calendar Spread Opens in Dropping Stock

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.