Market movers today

The US-China trade war continues to be the most important driver in financial markets. However, in the short term, we may not get much new information as no new measures are likely to be announced from either side. The next thing to look out for would be comments about a new round of talks or a potential phone call between Xi and Trump. It could initially be seen as positive. However, we would caution that the two sides seem quite far from each other on some key elements and we could end up in a war of attrition where it takes financial stress for the two sides to find a compromise.

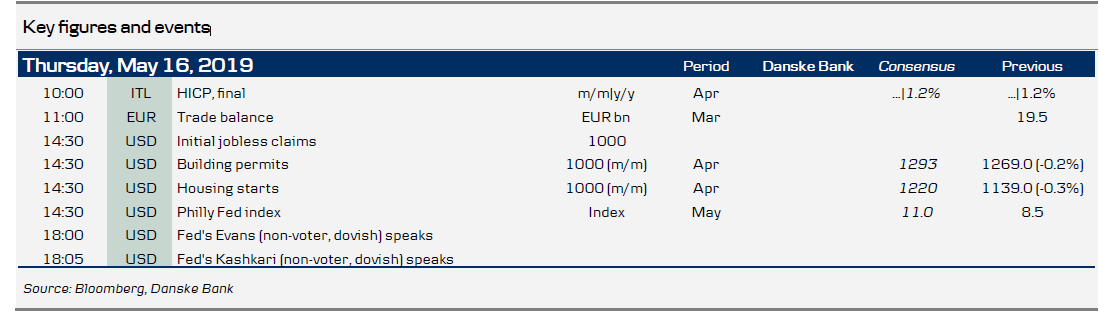

On the data front we have a batch of US key figures this afternoon. The Philadelphia Fed business confidence index for May will give more clues to the development of the US manufacturing sector.

We will also learn more about the state of the US housing market with the release of building permits and housing starts for April. The housing market has generally seen some improvement in recent months, most likely due to the decline in mortgage rates.

Selected market news

Yesterday, US April retail sales and industrial production figures missed expectations and point to a somewhat soft start to Q2. Across the Atlantic, German GDP growth rebounded to 0.4% q/q in Q1, after narrowly avoiding a recession in H2 18. Domestic demand was again the main growth driver, but part of the recovery in growth rates also reflects the unwinding of H2 18 temporary factors (car sector bottlenecks and low Rhine water levels). While it is encouraging that the domestic side of the economy continues to underpin the growth momentum, the near-term outlook for the German economy remains muted amid gloomy PMI readings, declining factory orders and an escalating trade war between two of Germany's most important export markets.

Added to that, the threat of US car tariffs - with the deadline for Trump's decision coming up on Saturday - is lingering in the background. However, news headlines yesterday suggested that Trump might opt to delay the tariffs by up to six months, as long as negotiations for a trade deal with the EU and Japan are ongoing, see here . However, the executive order has not yet been officially signed by President Trump and even then uncertainty would just be delayed rather than resolved.

Risk sentiment generally remained under pressure as markets grapple with the implications of the intensifying Sino-American trade war, with Trump's latest decision to effectively ban Huawei from selling technology into the American market further deepening the rift. Although shares in US and European automakers cheered the delayed car tariffs, Asian stocks remain in the red this morning and S&P 500 futures point to a lower opening. Yesterday, 10Y Bund yields fell to their lowest level since the autumn of 2016, but pared gains later in the day as news hit about Trump's decision to delay car tariffs.

Scandi markets In Sweden, Stefan Ingves will talk about the payment market (12:45) and Martin Flodén participate in a Czech NB conference (14:30). Ingves’ speech seems unrelated to monetary policy, while Flodén’s topic is challenges for monetary policy in Europe, which could potentially be more interesting from a market perspective.

Fixed income markets

The risk-off sentiment continues to dominate the global bond markets with Bunds and Treasuries outperforming in a bullish curve flattener and a widening of the Bund spread. Furthermore, there is still pressure on Italy, where it is becoming more like a credit “event” as the Italian government yield curve is subject to a bearish flattening, although we are not seeing a widening between high-coupon and the low-coupon bonds yet.

There are few important economic key numbers. Hence, the market will continue to be dominated by trade-related headlines. France is coming to the market today with taps in the 3Y and 6Y nominal bonds and linkers in the 4Y, 10Y and 17Y segments.

FX markets

The SEK has suffered lately at the hands of a soft Riksbank and seeing as the accommodative stance is here to stay for a while, there is no turnaround for the SEK in sight. Our short-term models do, however, indicate that EUR/SEK is somewhat overbought, and thus there is scope for some SEK-support, albeit limited, in the short run.

Further, the market has already priced out almost all probability of a rate hike this year, which might alleviate some of the pressure on the SEK for now. However, we believe there is a clear risk that Swedish growth and inflation will undershoot the Riksbank’s forecasts further out on the horizon, and that monetary policy will have to remain accommodative for the foreseeable future. Therefore, on balance, we raise our 1M forecast to 10.70, 3M (NYSE:MMM) to 10.80, 6M to 10.90 and 12M to 11.00. For further details, see May’s FX forecast update. The market continued to price Fed cuts yesterday, but despite the big move in US rates, EUR/USD was largely untouched. Today and in the coming days, leading Fed members are set to speak and will likely have to answer to the recent development in markets. We still expect EUR/USD to trade around 1.12-1.13 in 1-3M.

EUR/GBP is trading above 0.87 (top of our expectations for the range). This has come about as in the past weeks, markets have shifted increasingly to price a "no outcome" in the UK cross-party talks. May has announced there will be another vote on 3 June (and is exploring options to change the deal with the EU), but that as usually looks optimistic at best. We do not expect the GBP to trade materially weaker than this.