Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Despite a recent pullback in equities, we continue to feel confident in the U.S. economy and believe equities can move higher in 2018.

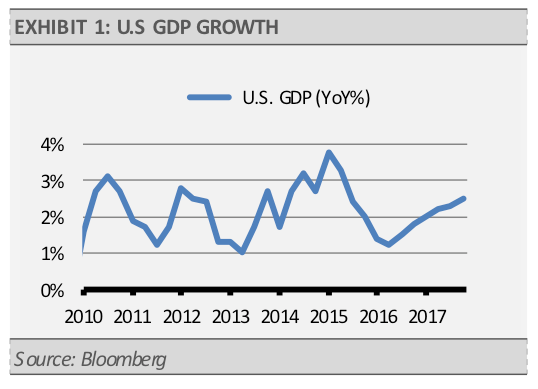

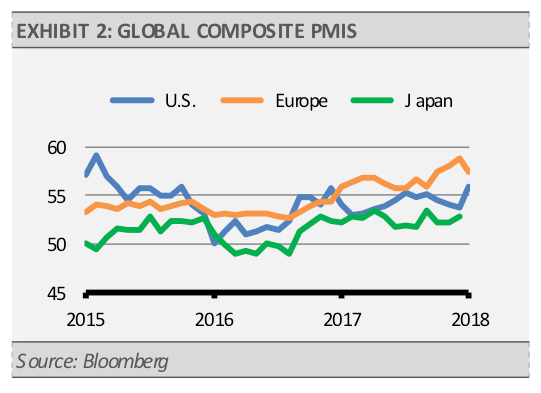

However, we think that stock price appreciation will be at a much slower pace than has been experienced over the last year. Globally, economic growth appears to be synchronized with both Europe and Japan benefiting from positive fundamentals driven by stable monetary policies, which lean towards the accommodative side. Domestically, stock prices have moved higher, however, there is still room for more upside as fundamentals remain favorable and we should soon see the impact of favorable fiscal policies on corporate earnings, as well as government and corporate spending. From there, we expect an acceleration in U.S. GDP growth in 2018 in addition to positive GDP growth abroad. We think an environment like this should be supportive of the industrials sector in 2018.

The industrials sector encompasses several industries, such as aerospace and defense, construction and construction-related companies, equipment, and transportation. In general, the global economic indicators that we track continue to suggest growth and stability in 2018, which should be favorable for the industrials sector. Increases in growth and output, coupled with corporate tax reforms, will likely increase demand and spending. Additional government spending on defense and infrastructure will also be a potential positive driver of performance in the industrial sector.

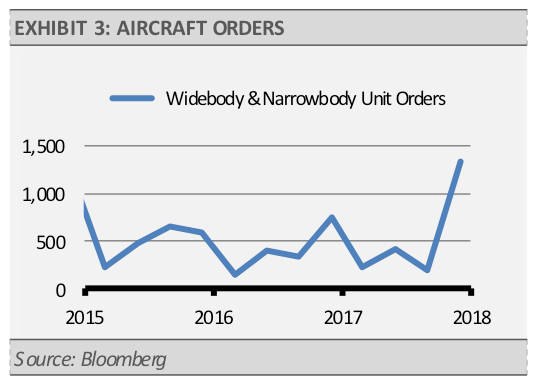

Fundamental indicators reflect support for the aerospace and defense industry, a key space in the industrials sector. Demand appears strong for aircraft globally. Additionally, with corporate tax-cuts in the U.S., we expect stronger demand for smaller airplanes to grow. Finally, an increase in defense spending domestically should also bode well for the industry.

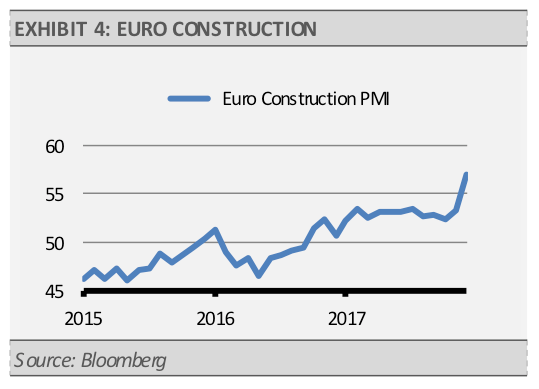

Construction and construction-related companies also face positive indicators. Momentum in domestic construction is expected to continue with non-residential construction picking up speed. Globally, we are also seeing positive fundamentals for construction.

Other industrial industries should also benefit from growing demand as global economies improve and stabilize. As demand and output remain stable, transports should see support. A successful infrastructure spending bill would provide a further boost to equities in the industrial sector.

There are several options available for investors wanting to add dedicated exposure to industrials. For a pure U.S. play, the Vanguard Industrials (NYSE:VIS) gives broad industrials exposure in a low-cost indexing approach. The John Hancock Multifactor Industrials (NYSE:JHMI) also invests in domestic stocks within the sector but screens the universe based on several factors, such as value. Finally, investors looking for global exposure might consider the iShares Global Industrials (NYSE:EXI), which provides roughly an even split between industrials from the U.S. and other developed countries.