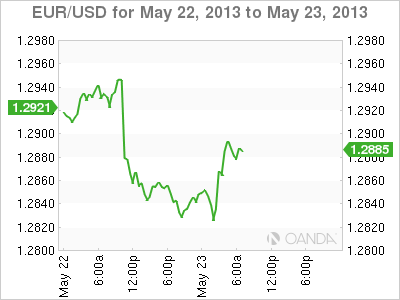

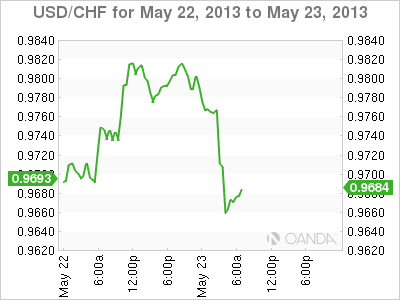

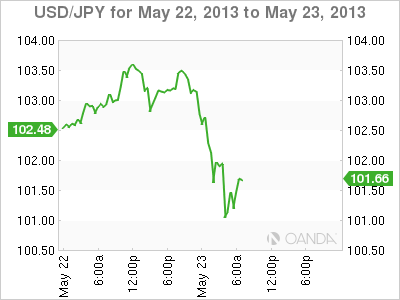

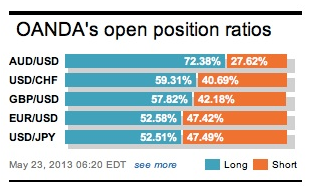

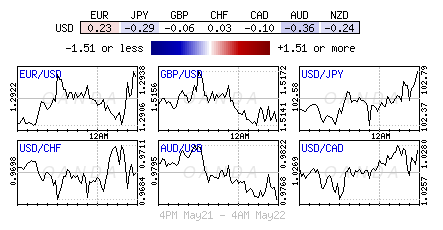

Risk aversion seen in Asia is showing little signs of slowing up as we head into the North American session. There has been a rush to safety with both the CHF and yen higher across the board. The EUR bulls have found some temporary solace from the better than expected run of euro PMI’s. However, both China and Ben are being blamed for the latest market turbulence.

In his prepared testimony yesterday, the Fed Chairman focused on justifying his fellow policy cohort’s aggressive monetary accommodation to date, as opposed to saying too much about the future outlook. While a number of participants were in favor of tapering asset purchases as early as in June, most agreed that further progress on the activity front would be required before slowing the pace of purchases would become appropriate. This is in line with the flexible approach approved and promoted by Bernanke to the joint economic committee in an earlier meeting.

US data is going to tell us when and when is “not” now for the FOMC to begin scaling back their monthly purchases of bonds. Ben started yesterday sounding like the same old dovish self. He acknowledged some of the drawbacks of persistently low interest rates and cautioned that premature tightening carried a substantial chance of killing the US recovery. However, the mere mention of tapering by Ben struck a raw nerve, sending the “mighty” dollar immediately higher, and reversing the fine bear-run supported by his dove views. In the Fed’s ideal world such a move would of course be data dependent.

By day’s end yesterday all investors seemed to have achieved was a zero-sum FX move with a lot of noise in between and this despite the market's getting the required volatility that enhances both trade positions and profit possibilities. All that ‘huffing and puffing’ made for an interesting lay up for China’s surprising economic releases last night.

The world’s second largest economy saw its own manufacturing PMI fall below 50 for the first time in eight-months, after the HSBC flash PMI reported 49.6 in May compared with a final print of 50.4 for April. Digging deeper, both new orders and export orders were below 50 – new export orders rose +0.9 points to 49.3, but new orders fell -1.7 points to 49.5. Numbers like this would suggest further weakness in domestic demand. China’s new administration continues to suggest that they “have the appetite to tolerate slower growth while pursuing structural reforms.” Weaker Chinese data will continue to undermine regional currencies value – investors remain weary of being long antipodean positions even after the recent large retreat. China remains Australia’s largest trading partner.

The 17-member single currency is in better shape this morning after their own stronger than expected PMI releases. The composite euro-zone PMI managed to print 47.7 compared to expectations of 47.2 and 46.9 in April. The breakdown shows both the services and manufacturing PMI’s beat expectations. However, the headline prints remain well below the desired 50-benchmark, with Germany showing further signs of recovery while most of the other Euro-zones remain deep in contraction territory.

Economically, Germany is Europe’s backbone, and despite a stronger headline print the country is in contraction territory (49.9). With German new orders contracting analysts will eventually expect employment to become a bigger issue. Europe has relied heavily on the German consumer to take up some of the slack in euro exports – but, with no jobs this equals less consumption which eventually leads to a more deeply contracting Europe. The euro-zone policy focus is shifting towards promoting growth rather than trying to put out the fires.

Even though risk aversion promotes holding yen, it’s the “capitulation” trade that underlies much of the USD/JPY move lower this morning along with a few ‘official comments’. Japan’s Economic minister said that the yen’s gain is a natural reaction to a curb of the overly rapid equity rise.

Currently, being long USD/JPY and long Japanese equities is the most crowded trade. MOF data last night revealed that the domestic investor was selling foreign assets again last week – which would suggest that there is little substance behind the USD/JPY rally apart from positioning. The market is deeply negative on the yen, which would suggest that dollar bids remain on the downside, however, with a lack of substance, investors should remain weary of aggressive moves higher for the dollar.

After focusing on the BoJ, BoE and Fed so far this week the market will shift gears and now gets to listen to Draghi at the ECB today. The North American investor will be looking at US jobless claims, flash PMI’s, home prices and sales for market directional clues.

Will capitulation continue to support the risk aversion trade? The dollar yen move especially, is eyeing some massive stops below, close to the 101 handle as the market remains short yen and vulnerable.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Capitulation Trade Has Short Yen Positions Worried

Published 05/23/2013, 08:32 AM

Updated 07/09/2023, 06:31 AM

Capitulation Trade Has Short Yen Positions Worried

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.