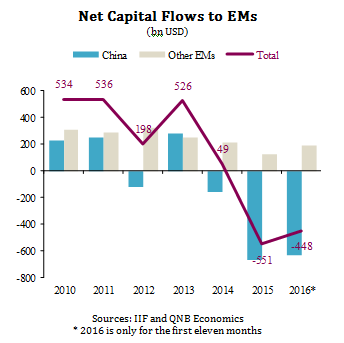

Since the taper tantrum of 2013, capital flows to emerging markets (EMs) have deteriorated. In 2016, EM capital flows did recover slightly but they remained well below their post-financial crisis average. This trend holds true both for China, which dominates EM capital flows, and for other EMs. The drivers of improved capital flows in 2016, predominantly lower interest rates in advanced economies, are unlikely to persist going forward. As a result, we expect EM capital flows to be subdued in 2017.

Overall net capital outflows from EMs fell to USD448bn in the first eleven months of 2016 from USD551bn in 2015, based on data from the Institute of International Finance (IIF). Dominating the flows was capital escaping from China, where net outflows totalled USD635bn in the first eleven months. Following changes to the currency regime in China in 2015, Chinese residents anticipated further weakening of the yuan against the US dollar and began taking money out of China. This led to an intense bout of capital outflows of around USD100bn in both December 2015 and January 2016. The yuan continued to weaken during the remainder of 2016, resulting in steady outflows. In 2017, we expect outflows to continue, but at an orderly pace as the authorities manage a gradual depreciation of the yuan while also increasing capital controls to limit the rate of outflows.

Outside China, net capital flows into other EMs recovered slightly in 2016 to USD187bn from USD123bn. However, this remained well below the post-financial crisis average of USD249bn. Capital inflows to EMs were likely supported by two main factors.

First, looser than expected monetary policy in advanced economies made higher yields in EMs more attractive. At the start of 2016, the US Federal Reserve expected to hike interest rates four times. However, the Fed ended up raising rates only once and this came in December 2016. Furthermore, bond yields in many advanced economies fell into negative territory. In the middle of the year, German bund yields fell as low as -0.2% and Japan's 10-Year yields fell to -0.3%.

Second, a softer than expected landing in China has reduced concerns about EMs in general. Many EM economies rely on robust Chinese demand for their manufactured and raw products. At the outset of the year, the IMF expected China’s economy to grow 6.3% in 2016. However, in its latest forecasts, the IMF has revised up estimates of China’s 2016 growth to 6.7%. Stronger than expected growth in China has alleviated concerns about a hard landing for the world’s largest economy and supported capital flows to EMs.

However, the prognosis for 2017 EM capital flows is not pretty. Since the election of Donald Trump as the President of the US, yields have spiked across advanced economies on the prospect of fiscal stimulus and higher growth. U.S. 10-Year yields are now at 2.3%, up from a low of 1.4% in 2016 while 10-year yields in Germany and Japan are 0.3% and 0.1% respectively. The IIF estimates that EMs had the worst month of capital outflows in November (the month of Trump’s election) since the taper tantrum in 2013 and that outflows continued in December. Furthermore, with talk of ECB tapering QE, a return to the low-yield environment of 2016 seems unlikely. Finally, with debt in China now well over 200% of GDP, concerns about a financial crisis could re-emerge, with negative ramifications for other EMs.

In summary, the ongoing depreciation of the Chinese yuan, higher yields in advanced economies and the risk of slower growth in China are all likely to drag on capital flows to EMs in 2017. Higher oil and commodity prices could cushion the blow for commodity exporters. However,aggregate capital flows are likely to remain depressed, resulting in weaker currencies, tighter monetary policy and slower growth.