West Africa exploration with technology twist

EUR/CVE is a new entrant to the plethora of junior E&Ps elephant hunting in West Africa. The company is at a relatively early stage, requiring further seismic before drillable prospects are identified in its two key areas, Guinea-Bissau and Senegal. However, management connections and potentially game-changing access to Rex International’s Virtual Drilling technology sets it apart from peers in terms of profile.

Portfolio building continues

Cap started building its exploration portfolio in 2013 with its entry into Blocks 1 and 5B in Guinea-Bissau. New 2D seismic has already been shot, resulting in an impressive increase in resource estimate at Block 5B to 2,750mmboe gross (Cap 27%), while updated Block 1 numbers are due imminently. 2014 should now see follow-up 3D seismic with a view to identifying targets for drilling in 2015/16. Meanwhile, 2D is currently being shot in Senegal that Cap expects to identify a target it can drill in 2015. Beyond the current portfolio we expect Cap to continue to acquire acreage that may include production/ near production to provide cash flow.

Virtual Drilling may provide technology edge

Cap’s partner in both Guinea-Bissau and Senegal is Trace Atlantic, which has exclusive rights to Rex International’s Virtual Drilling, a technology that claims it can predict the presence (or absence) of liquid hydrocarbons through the interpretation of seismic data using a software-based tool to extract and examine low frequency bands. Virtual Drilling would be a game changer both for Cap and for the industry if definitively proven, as it would de-risk drilling prospects prior to drilling. Blind testing of the technology has been very successful to date, and recently was used for the first time in the field offshore Oman, again successfully.

Valuation: Too early to ascribe a RENAV

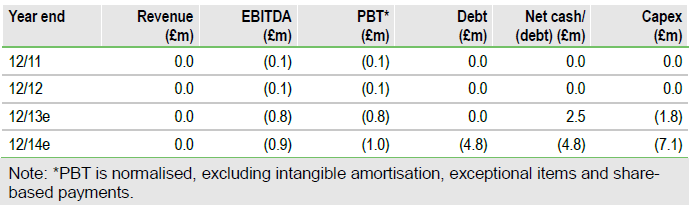

We consider it too early to assign a RENAV to Cap. However, there is significant upside potential if the company can upgrade its leads to drill-ready prospects. We estimate a 300mmboe prospect would add between 11p and 102p per share depending on the acreage and PSC terms. Meanwhile, Guinea-Bissau blue-sky valuations could exceed £20/ share, although this is speculative pending further 3D seismic. We estimate Cap will need c £5m in 2014 to fund its planned 3D work programme in Guinea-Bissau that may be funded from a planned AIM listing in H214. Drilling is not likely until at least 2015 and currently remains unfunded.

To Read the Entire Report Please Click on the pdf File Below