Cannabis stocks rose following recommendations from the US Department of Health and Human Services (HHS) that cannabis be reclassified to Schedule III - a designation applied to drugs with a moderate to low potential for physical and psychological dependence. ETFs in the US tracking the Cannabis and psychedelics theme soared on the news, gaining +30.49% on average week-over-week.

For context, Schedule I substances are considered highly addictive with no medicinal value and include drugs such as heroin and LSD. At the other end of the scale, Schedule III substances include products that are deemed to possess moderate dependency risk but documented medicinal benefits, such as Tylenol with Codeine or Ketamine. This proposed reclassification indicates acknowledgment at the federal level of the potential therapeutic benefits offered by marijuana. Medical cannabis is already approved in multiple states across the country, suggesting a steadily growing acceptance of its medical application.

The cannabis sector experienced an acceleration in trading volumes off the back of this encouraging announcement, with investors adopting a more favorable outlook towards the regulatory landscape of this burgeoning industry. Such policy shifts could help facilitate more comprehensive research into the health implications of Marijuana use, previously hampered by the serious restrictions imposed by its Schedule I category designation under the Controlled Substances Act (CSA).

More importantly, the proposed reclassification could also help remove barriers currently preventing formal banking relationships between federally regulated financial institutions and businesses dealing directly or indirectly, with marijuana sales and distribution. Greater compliance clarity over time will no doubt encourage participants deeper within mainstream markets, thereby driving further growth opportunities.

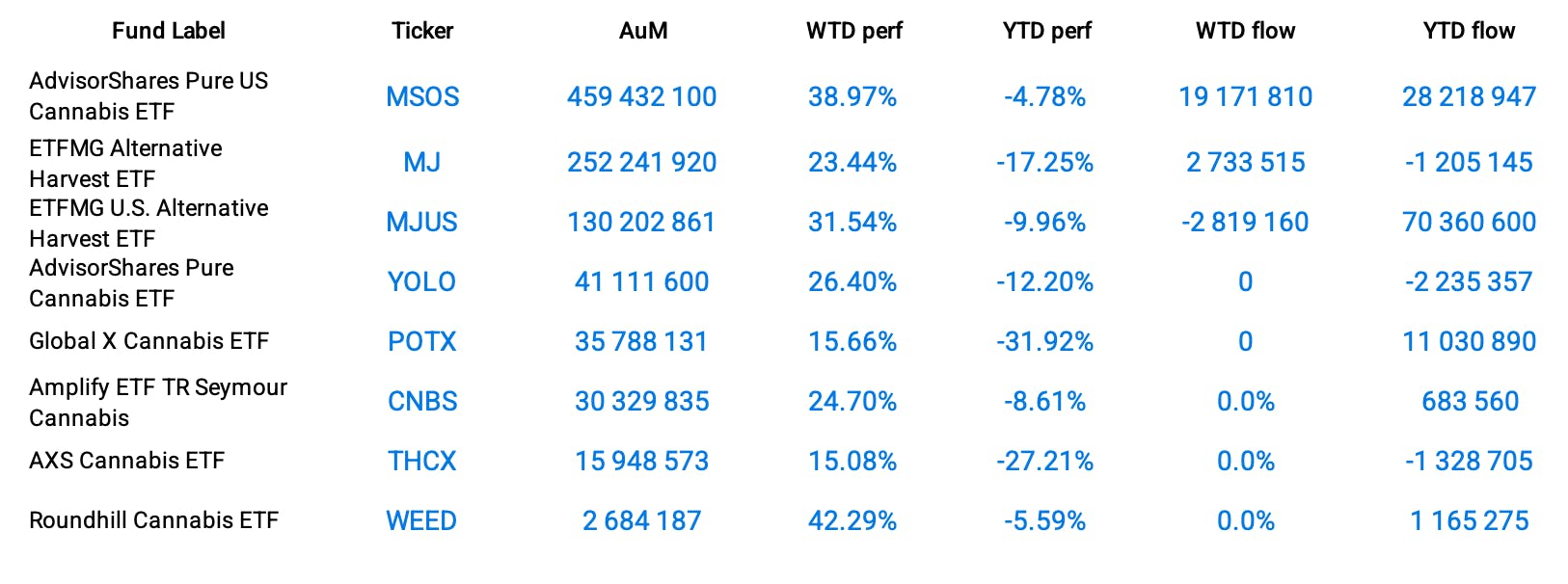

As an illustration of the positive impact of this news on Cannabis funds, the AdvisorShares Pure US Cannabis ETF (MSOS) gained 38.97% over the week with inflows of more than $19 million.

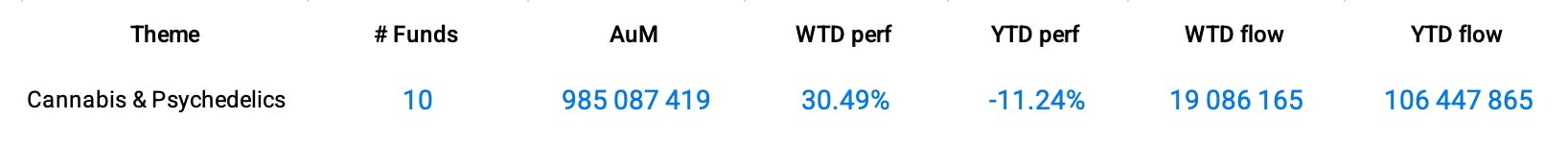

Group Data: Cannabis & Psychedelics Segment

Funds Specific Data: MSOS, MJ, MJUS, YOLO, POTX, CNBS, THCX, WEED

This content was originally published by our partners at ETF Central.