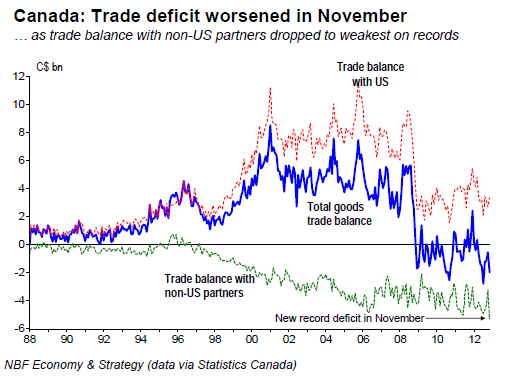

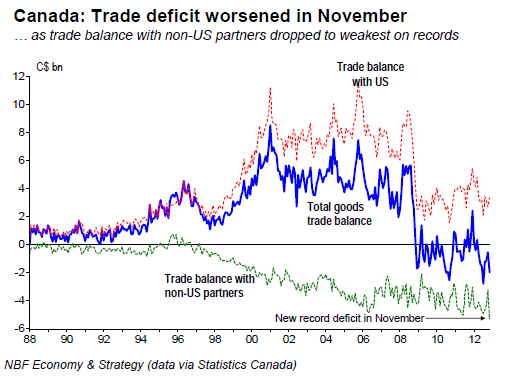

FACTS: Canada’s merchandise trade deficit widened to CAD 2 bn in November from a revised CAD 0.6 bn deficit. That was much worse than expected than consensus which was looking for a deficit of only CAD 0.6 bn. In November, an improving trade surplus with the US was offset by a record deficit with non-US trade partners (top chart).

Exports fell 0.9% as increases in revenues from sales of autos (+6.6%), aircrafts (+4.4%) and basic industrial goods (+7.5%) were more than offset by declines in most other categories including the 1.2% drop in energy. Imports rose 2.7%, with broad-based gains more than offsetting the 3.7% drop in energy. In real terms exports rose just 0.1% (after the 1.6% slump in October), while imports increased 2.5%.

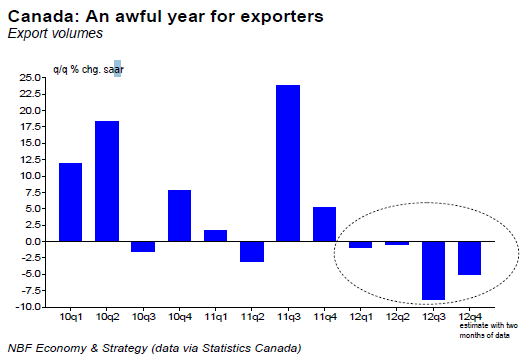

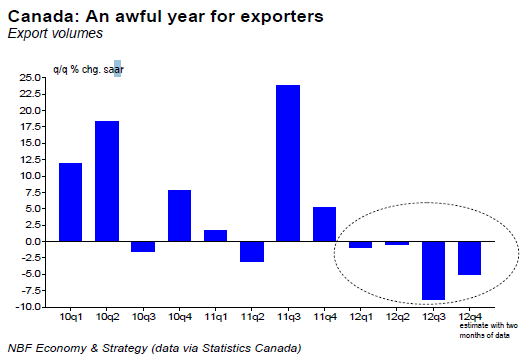

OPINION: The November trade report was weaker than expected in Canada as the expected rebound in auto exports was offset by weakness elsewhere. With two months of data, total export volumes are tracking an annualized decrease of around 5.1% in Q4 (due to the October slump), after declines in the prior three quarters.

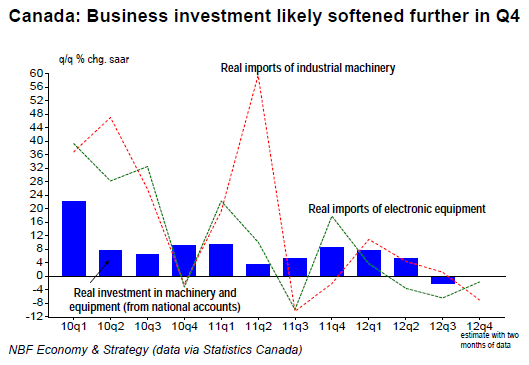

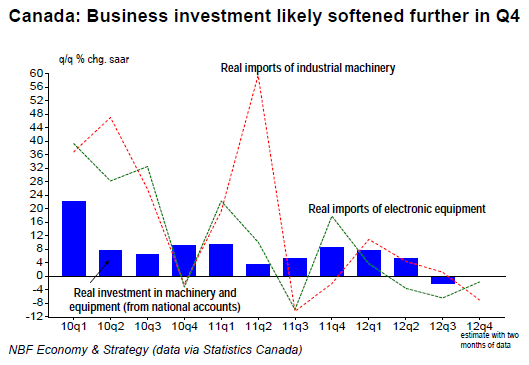

Clearly, 2012 has been an awful year for Canadian exporters (middle chart). After rising 0.8% annualized in Q3, real imports are tracking -2.2%, with softer imports of industrial machinery and electronic equipment which so far in Q4 are tracking -7% and - 1.7% respectively (bottom chart). That signals a second consecutive contraction in business investment spending in Q4.

It’s becoming clearer that Q4 won’t see the 2.5% GDP growth that the Bank of Canada had expected. We’re expecting the economy to continue to grow at a snail’s pace of under 1% annualized for the second quarter in a row in Q4. So much so, that the output gap won’t close until late 2014 at best, even under the BoC’s arguably optimistic forecasts for 2013 and 2014. All told, this isn’t an environment conducive for interest rate hikes in 2013.

Exports fell 0.9% as increases in revenues from sales of autos (+6.6%), aircrafts (+4.4%) and basic industrial goods (+7.5%) were more than offset by declines in most other categories including the 1.2% drop in energy. Imports rose 2.7%, with broad-based gains more than offsetting the 3.7% drop in energy. In real terms exports rose just 0.1% (after the 1.6% slump in October), while imports increased 2.5%.

OPINION: The November trade report was weaker than expected in Canada as the expected rebound in auto exports was offset by weakness elsewhere. With two months of data, total export volumes are tracking an annualized decrease of around 5.1% in Q4 (due to the October slump), after declines in the prior three quarters.

Clearly, 2012 has been an awful year for Canadian exporters (middle chart). After rising 0.8% annualized in Q3, real imports are tracking -2.2%, with softer imports of industrial machinery and electronic equipment which so far in Q4 are tracking -7% and - 1.7% respectively (bottom chart). That signals a second consecutive contraction in business investment spending in Q4.

It’s becoming clearer that Q4 won’t see the 2.5% GDP growth that the Bank of Canada had expected. We’re expecting the economy to continue to grow at a snail’s pace of under 1% annualized for the second quarter in a row in Q4. So much so, that the output gap won’t close until late 2014 at best, even under the BoC’s arguably optimistic forecasts for 2013 and 2014. All told, this isn’t an environment conducive for interest rate hikes in 2013.