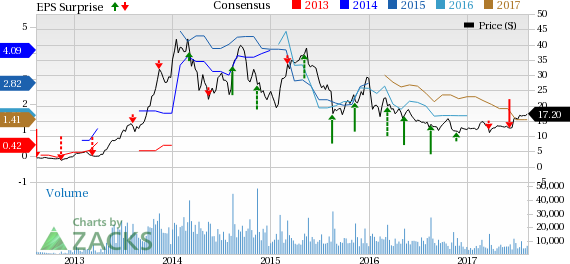

Solar cell manufacturer, Canadian Solar Inc. (NASDAQ:CSIQ) , witnessed second-quarter 2017 adjusted loss of 15 cents per share, narrower than the Zacks Consensus Estimate of a loss of 16 cents. In the year-ago quarter, the company posted earnings of 68 cents.

Barring the adjustments, the company posted an earnings of 63 cents per share.

Total Revenue

Canadian Solar recorded total revenue of $692.4 million in the reported quarter, which surpassed the Zacks Consensus Estimate of $623 million by 11.1%. However, the top line was down 14.1% from $805.9 million reported in the prior-year quarter.

Of the total revenue, the American markets comprised 21.7%, Asia represented 65.3%, and the European and other markets contributed 13% compared with the respective year-ago contributions of 47.6%, 39.5% and 12.9%.

Operational Update

Solar module shipments in the quarter totaled 1,745 megawatts (MW), up 35.3%, from the year-ago level of 1,290 MW. The figure also exceeded management’s guidance range of 1,530 MW –1,580 MW.

Gross profit was $167.8 million, up 21.2%, from the year-ago level of $138.5 million. Gross margin was 24.2% in the quarter compared with 17.2% in the prior-year quarter.

Total operating expenses were $84.1 million, up 15% year over year. Operating expenses decreased as it recorded other operating income of $15.5 million.

Selling expenses totaled $39.3 million in the reported quarter, up 16.1%. General and administrative expenses were $53 million, slightly up from $52.9 million. Research and development expenses were $7.3 million compared with $5.1 million a year ago.

Interest expenses were $26.7 million, up from the year-ago level of $11.9 million.

Financial Update

As of Jun 30, cash and cash equivalents were $961.6 million, up from $511 million as of Dec 31, 2016.

Long-term debt as of Jun 30 was $273 million, down from $493.5 million as of Dec 31, 2016.

Guidance

For third-quarter 2017, Canadian Solar expects shipments in the band of 1.65−1.70 gigawatts (GW). Total revenue is projected in the range of $805−$825 million, along with gross margin of 15–17%.

Canadian Solar’s total module shipments in 2017 are still anticipated to be in the range of 6.0 GW–6.5 GW.

Zacks Rank

Canadian Solar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

SunPower Corp. (NASDAQ:SPWR) incurred second-quarter 2017 loss of 39 cents per share, narrower than the Zacks Consensus Estimate of a loss of 63 cents. In the year-ago period, the company had witnessed a loss of 33 cents.

8point3 Energy Partners LP (NASDAQ:CAFD) reported earnings of 12 cents per share in second-quarter fiscal 2017 (ended May 31, 2017), missing the Zacks Consensus Estimate of 16 cents by 25%.

First Solar Inc. (NASDAQ:FSLR) reported second-quarter 2017 earnings of 64 cents a share. The Zacks Consensus Estimate was pegged at a loss of 4 cents. The reported figure declined 26.4% from the prior-year figure of 87 cents.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

First Solar, Inc. (FSLR): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

8point3 Energy Partners LP (CAFD): Free Stock Analysis Report

Original post

Zacks Investment Research