Investing.com’s stocks of the week

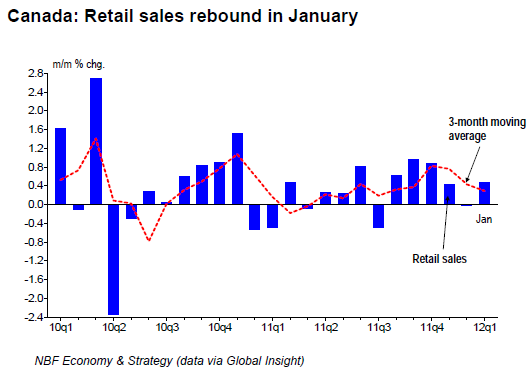

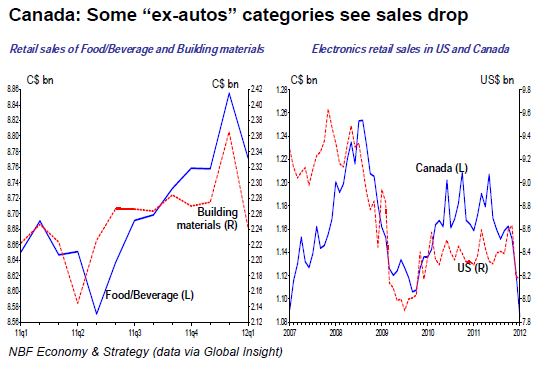

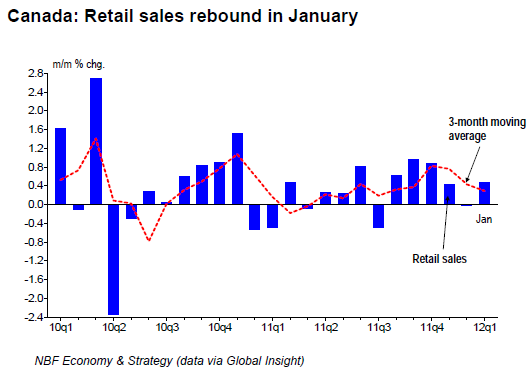

FACTS: Canadian retail sales rose 0.5% in January (top chart) disappointing consensus which was looking for a 1.8% increase. The prior month was upgraded a bit from an initially estimated 0.2% decline. As expected, autos were the driver of gains, with a 3.7% increase in sales. Excluding autos, however, sales fell 0.5%. Gains in sales of clothing, health/personal care were more than offset by declines in other ex-auto categories including the 3.4% drop in electronics and 5.2% decrease in building materials. Thanks to autos, sales of discretionary items, i.e. total retail sales excluding groceries, health/personal care products, and gasoline, rose 0.8%. Four of the ten provinces saw sales declines. With its 0.7% monthly drop, Quebec retail sales are now just 2.5% higher than January of last year, the lowest year-on-year growth among provinces.

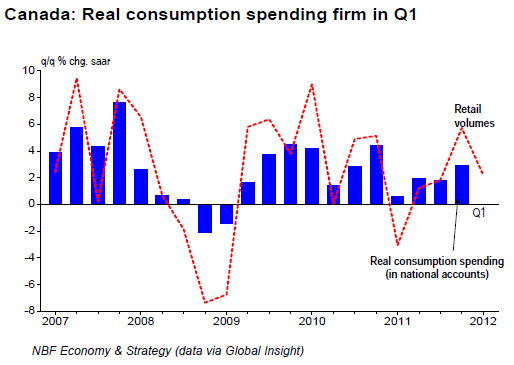

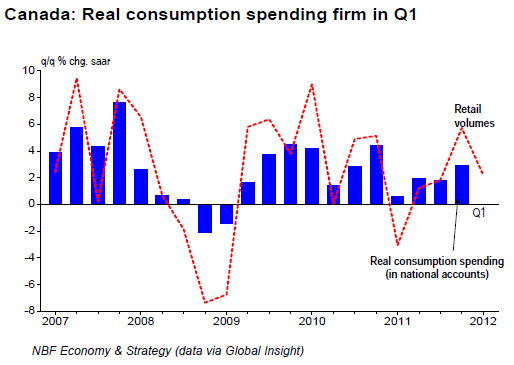

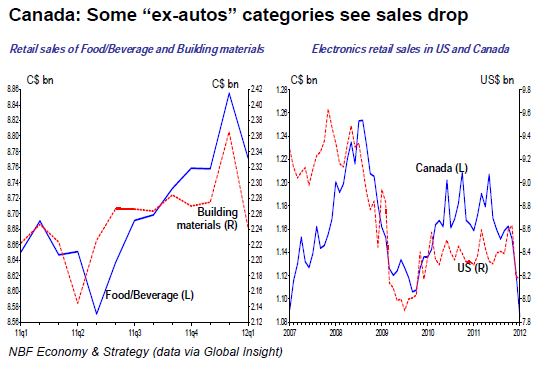

OPINION: While the retail report was below consensus expectations, that doesn't negate the fact that Canadian consumers got off to a decent start in 2012. With the 0.3% increase, retail volumes are tracking a healthy 2.2% annualized in the first quarter of the year (middle chart). The drop in ex-auto sales has to be looked at in context. That comes after eight straight increases. Moreover, January’s drop coincided with a correction after an outsized December increase for two big categories, namely food/beverages and building materials which together account for over one third of ex-auto sales. The continuing decline in the electronics category didn’t help, but that’s not a Canadian exception, since we’ve been seeing a similar trend in the US as better technology is translating into lower prices (bottom chart). Overall, the gains in retail volumes should help somewhat offset weakness in real manufacturing and wholesaling in January, with GDP in the month looking flat at this point.

OPINION: While the retail report was below consensus expectations, that doesn't negate the fact that Canadian consumers got off to a decent start in 2012. With the 0.3% increase, retail volumes are tracking a healthy 2.2% annualized in the first quarter of the year (middle chart). The drop in ex-auto sales has to be looked at in context. That comes after eight straight increases. Moreover, January’s drop coincided with a correction after an outsized December increase for two big categories, namely food/beverages and building materials which together account for over one third of ex-auto sales. The continuing decline in the electronics category didn’t help, but that’s not a Canadian exception, since we’ve been seeing a similar trend in the US as better technology is translating into lower prices (bottom chart). Overall, the gains in retail volumes should help somewhat offset weakness in real manufacturing and wholesaling in January, with GDP in the month looking flat at this point.