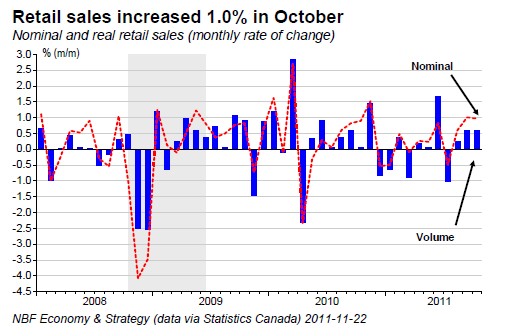

Retail sales increased 1.0% in October, following a 1.0% increase in September. Sales increased in 7 of 11 retail industries. Motor vehicles and parts sales were up 2.0%, after a 3.3% rise in September. Excluding motor vehicles and parts, retail sales were up 0.7% with the largest increase registered by clothing & clothing accessories stores and gasoline stations (+1.8%). This month’s worst performers were furniture & home furnishings stores (-0.8%) and miscellaneous store retailers (-0.8%). On a regional basis, sales were up in 8 provinces. The strongest increase was observed in Alberta (+3.0%) while Ontario (-0.1%) and Nova Scotia (+0.0%) lagged. In September, volume retail sales were up 0.6%, after increasing 0.6% in September (top chart).

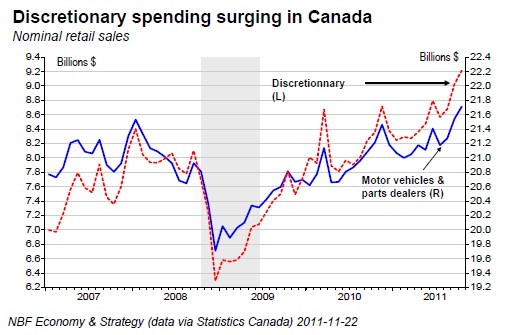

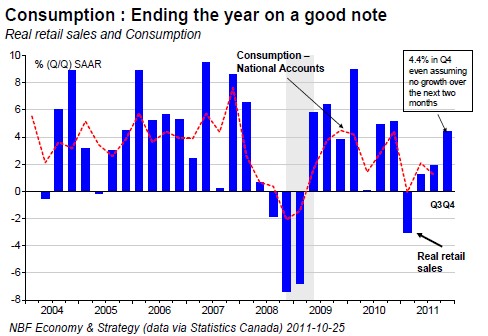

OPINION: October’s retail sales increase was twice the pace expected by the consensus. This performance was all the more impressive as it comes on the heels of a 1.0% increase in September. Some will be surprised by this performance given the recent softening in labour market (jobs were down in 3 of the last four months). Still one must not forget that total hours worked were up a whopping 4.7% in Q3, providing some support in the quarter. Discretionary spending, which we define as sales excluding groceries, gasoline and healthcare is currently on track to expand 8.8% in nominal terms in Q4, the best showing in almost two years, a sign of health of Canadian consumers. Even assuming no growth over the next to months, volume sales would be expanding at a 4.4% clip, up markedly from 1.9% in Q3. As a result, we expect consumption to grow by 2.4% in Q4, its best quarterly showing in 2011. Although labour market performance in Q3 partly explains recent retail sales strength, some of it was most certainly achieved through a higher debt load (motor vehicles sales hit a new record high in October in $ terms). In light of the recent deceleration of the labour market and already indebted households, the consumption growth rate is likely to hand up being between 1.5% and 2% in 2012.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Retail Sales Increased 1.0% in October

Published 12/22/2011, 05:42 AM

Updated 05/14/2017, 06:45 AM

Canadian Retail Sales Increased 1.0% in October

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.