Investing.com’s stocks of the week

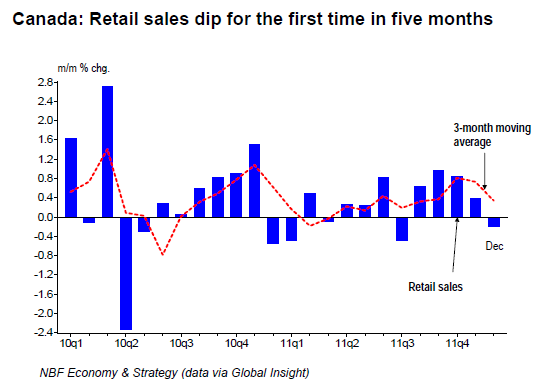

FACTS: Canadian retail sales fell 0.2% in December in line with consensus expectations. That was the first drop in sales in five months (top chart). The decline was partly driven by weak auto dealership revenues which fell 1% in the month. Excluding autos, retail sales were flat as gains in furniture (+3.2%), building materials (+2.4%) and food/beverages (+1.2%) offset declines elsewhere including gasoline (-1.1%), clothing (-0.8%), sporting goods (-3.4%) and electronics (- 2.8%). In real terms, retail sales were flat.

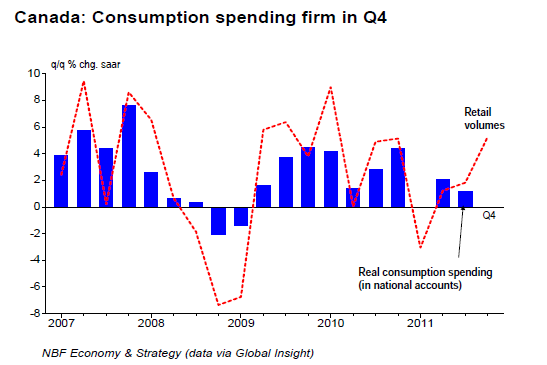

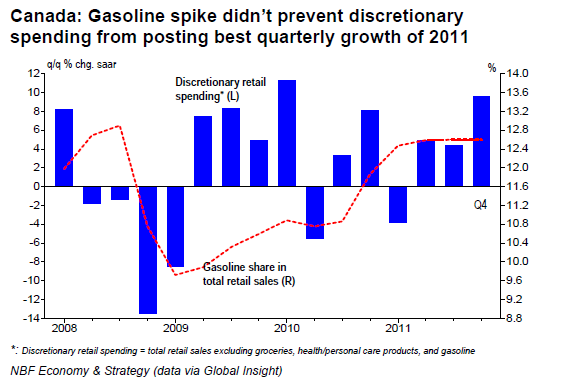

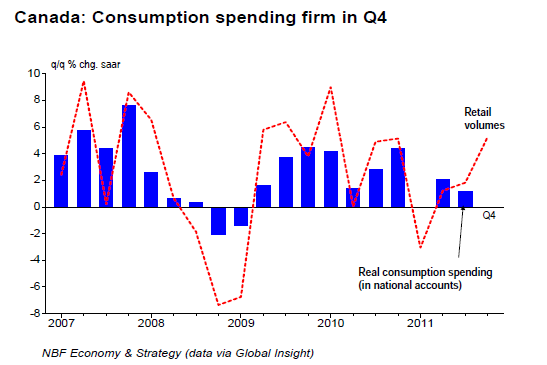

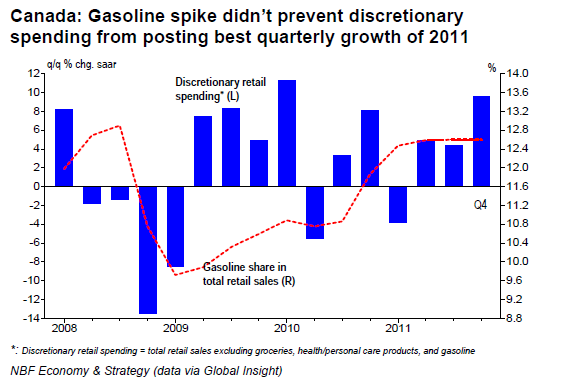

OPINION: Despite December’s flat volumes, real retail sales are up 5.3% annualized in the last quarter of 2011, the highest since Q1 of 2010. So expect a decen contribution from consumption spending in the quarter (middle chart). Note that the spending spree on durables extended into January if preliminary estimates for auto sales are any guide (+16% m/m). Those fly in the face of tepid employment reports of recent months and a period of elevated gasoline price. The share of gasoline in total retail sales averaged 12.6% in Q4, the highest since the energy price spike of 2008Q3, but that didn’t stop discretionary retail spending from growing at its highest pace in Q4 (bottom chart).

So, if the Labour Force Survey was indeed an accurate reflection of the Canadian employment situation, then one would expect the savings rate (which was at a multi-year low of 3.5% in Q3) to have dropped even further to accommodate the Q4 spending spree.

For the month of December, the earlier reported gains in real manufacturing as well as better wholesale volumes should offset the softness in retailing, allowing for a 0.2% or so increase in the month’s GDP. For the quarter as a whole, it looks like Q4 growth won’t be too far from the Bank of Canada’s 2% annualized estimate.

OPINION: Despite December’s flat volumes, real retail sales are up 5.3% annualized in the last quarter of 2011, the highest since Q1 of 2010. So expect a decen contribution from consumption spending in the quarter (middle chart). Note that the spending spree on durables extended into January if preliminary estimates for auto sales are any guide (+16% m/m). Those fly in the face of tepid employment reports of recent months and a period of elevated gasoline price. The share of gasoline in total retail sales averaged 12.6% in Q4, the highest since the energy price spike of 2008Q3, but that didn’t stop discretionary retail spending from growing at its highest pace in Q4 (bottom chart).

So, if the Labour Force Survey was indeed an accurate reflection of the Canadian employment situation, then one would expect the savings rate (which was at a multi-year low of 3.5% in Q3) to have dropped even further to accommodate the Q4 spending spree.

For the month of December, the earlier reported gains in real manufacturing as well as better wholesale volumes should offset the softness in retailing, allowing for a 0.2% or so increase in the month’s GDP. For the quarter as a whole, it looks like Q4 growth won’t be too far from the Bank of Canada’s 2% annualized estimate.