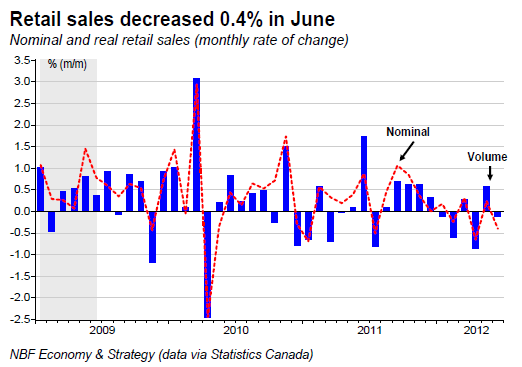

: Retail sales decreased 0.4% in June, following a 0.2% increase in May (revised down from +0.3%). Sales decreased in 7 of 11 retail industries. Motor vehicles and parts sales were down 0.4%, a third consecutive monthly drop. Excluding motor vehicles and parts, retail sales declined 0.4% with the largest pullback registered by building material and garden equipment (-2.1%), general merchandise stores (-1.5%) and gasoline stations (-1.3%).

This month’s best performers were miscellaneous store retailers (+1.4%) and electronics & appliance stores (+1.1%). On a regional basis, sales were down in 6 provinces. The strongest decrease was observed in Nova Scotia (-3.4%) while Quebec (+0.7%) was the best performer. In June, volume retail sales were down 0.1%, after increasing 0.6% in May (top chart).

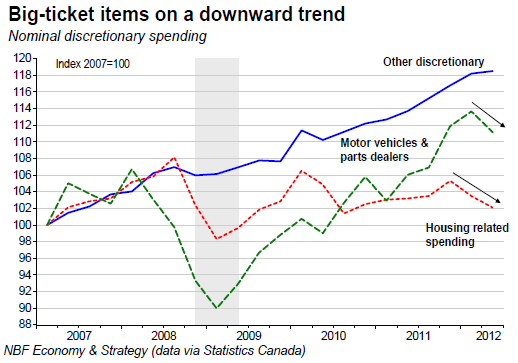

OPINION: The June retail report was much softer than expected indicating that the weak consumption environment continues in Canada. Indeed, retail sales are essentially at the same level they were last October, 8 months later. Big ticket items are particularly hit over that period. Housing related spending (furniture, electronics, appliances and building material) is declining 5.3% in Q2 (annualized), following a 6.8% pullback in Q1. Auto dealerships which have performed well in Q1 (+6.5%), lost all those gains in Q2 (-8.5%). As a result, discretionary spending is experiencing its worst performance in 2 years.

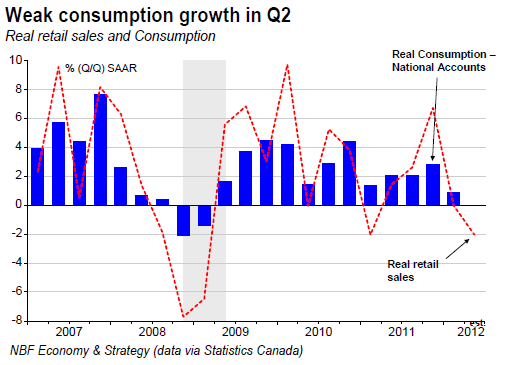

High gasoline prices and a drastic slowing in consumer credit are hurting overall spending in the quarter. Based on labour market data, wage gains are nevertheless very strong in Q2 indicating a possible increase in the savings rate which was at a very low level. With June's drop in volumes, real retail sales fell 2% annualized in the second quarter of 2012 suggesting limited contribution to GDP by consumers in Q2, after an unimpressive Q1. We continue to expect GDP growth to come out at 1.5%, below the Bank of Canada's 1.8% estimate for the quarter.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Retail Sales Decreased 0.4% In June

Published 08/23/2012, 08:40 AM

Updated 05/14/2017, 06:45 AM

Canadian Retail Sales Decreased 0.4% In June

FACTS

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.