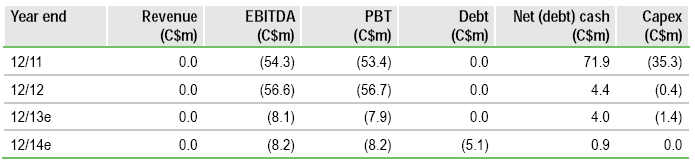

Canadian Overseas Petroleum (COPL) is a junior E&P company with principal focus offshore Liberia. COPL has brought in a strong working partner and operator in the shape of ExxonMobil (XOM), where playopening exploration success in early 2014 could unlock substantial value for shareholders. COPL is also planning entry into Nigeria by acquiring producing/development assets to lower its wider portfolio exploration risk. Based on current Liberia drill activity our RENAV value of C$0.36/share implies 44% upside. However, taking into consideration the play-opening potential of its Liberia block, we anticipate a risked M&A valuation of C$1.60/share in the event of exploration success.

Unlocking Liberia

COPL’s entry into Liberia was finalised in May 2013, with the company now holding a 17% stake in LB-13 in exchange for a C$120m gross carry that should see it drill two wells (including one sidetrack). Encouragingly, partner Exxon, aware of the fact that additional detailed seismic work has been completed by COPL to further delineate prospects, has already farmed into Block LB-13 offshore Liberia. In view of that work, we expect upside to existing CPR prospective resource estimates that currently sit at 2.6bnboe gross. The presence of Exxon gives a strong endorsement for the exploration acreage, and provides financial backing, technical expertise and scope to open up a new frontier basin in the event of exploration success.

Nigerian acquisitions

COPL is looking to increase its African exposure through entry in Nigeria via producing/and/or development assets. This would lower specific portfolio exploration risk in COPL, and may provide a useful source of income. COPL also has existing unconventional assets in New Zealand, where drilling is not planned until 2015.

Valuation: Exploration success key

Our DCF methodology results in a RENAV of C$0.36/share, which implies 44% upside; however, this is restricted to initial drill targets. COPL investors may ascribe value to the potential play opening economics of Liberia, although in the event of exploration success we consider there is still substantial upside, with M&A metrics suggesting a valuation of C$1.60/share. Getting to a drill-ready position has not been easy for COPL, having farmed out 83% of LB-13, although the terms of the deal are still above African industry metrics.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Overseas Petroleum

The appliance of science

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.