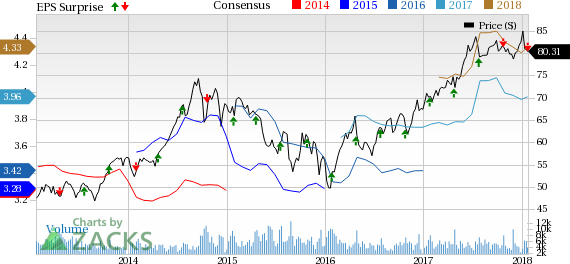

Canadian National Railway Company’s (NYSE:CNI) fourth-quarter 2017 earnings per share (excluding $1.79 from non-recurring items) of 94 cents (C$1.20) fell short of the Zacks Consensus Estimate of 98 cents. However, the bottom line inched up 1.1% from the year-ago tally.

Quarterly revenues of $2,573 million (C$3,285 million) also lagged the Zacks Consensus Estimate of $2,612.2 million but increased 7.2% year over year. Rail freight revenues, accounting for bulk of the top line in the reported quarter, improved 2%. The top line got a boost from strong international container traffic via the ports of Prince Rupert and Vancouver and increased volumes of frac sand, freight rate hikes and higher applicable fuel surcharge rates.

The earnings and revenue miss seem to have disappointed investors. Consequently, shares of the company were down 2.3% in after-hours trading on Jan 23.

Operating Results

On a year-over-year basis, freight revenues rose in segments like Metals and Minerals (20%), Coal (7%), Intermodal (13%) and Automotive (1%). However, the metric declined in Forest Products (2%), Grain and Fertilizers (10%) and Petroleum and Chemicals (5%). Overall, carloads (volumes) expanded 7% and revenue ton miles (RTMs) inched up 1% year over year. However, Rail freight revenues per carload declined 4% in the reported quarter.

The Coal sub-group performed most impressively with respect to car loads that surged 29%. The Metals and minerals segment reported 8% growth. While Forest products and Automotive segments registered an ascent of 4% and 2%, respectively. However, Petroleum and Chemicals segment declined 4% while Grain and fertilizers slid 1%. Also, the intermodal segment volumes fell 5% year over year.

In the quarter under review, operating income reduced 7% year over year to C$1,301 million. Operating ratio (defined as operating expenses as a percentage of revenues) was 60.4% compared with 56.6% in the year-ago quarter. Higher fuel and labor costs contributed to this key metric’s deterioration.

Liquidity

This Zacks Rank #3 (Hold) company exited the fourth quarter with free cash flow of C$457 million compared with C$777 million a year ago. Adjusted debt at the end of the quarter was C$11,306 million compared with C$11,470 million a year ago. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dividend Hike

The company’s board of directors has recently approved a 10% dividend raise to C$0.45 per share, payable on Mar 29, 2018 to shareholders of record as of Mar 8.

2018 Outlook

The company expects adjusted earnings per share of C$5.25-C$5.40 for 2018 compared with C$4.99 in 2017.

C$3.2 Billion Capital Program

The company’s C$3.2 billion capital program will focus on its core capacity projects to meet the growing freight demand and investments pertaining to infrastructural maintenance, thereby enhancing safety and efficiency of its network in the process. The program consists of $700 million investment to increase capacity as well as cover the acquisition of 60 new locomotives, track infrastructure expansion and improvements at intermodal terminals. The program also includes around C$1.6 billion for track infrastructure maintenance and approximately, C$400 million for the installation of Positive Train Control in the United States.

Upcoming Releases

Investors interested in the broader Transportation sector keenly await fourth-quarter earnings reports from the key players like American Airlines Group, Inc. (NASDAQ:AAL) , Southwest Airlines Company (NYSE:LUV) and Union Pacific Corporation (NYSE:UNP) , all scheduled to report respective earnings numbers on Jan 25.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Southwest Airlines Company (LUV): Free Stock Analysis Report

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Union Pacific Corporation (UNP): Free Stock Analysis Report

Canadian National Railway Company (CNI): Free Stock Analysis Report

Original post

Zacks Investment Research