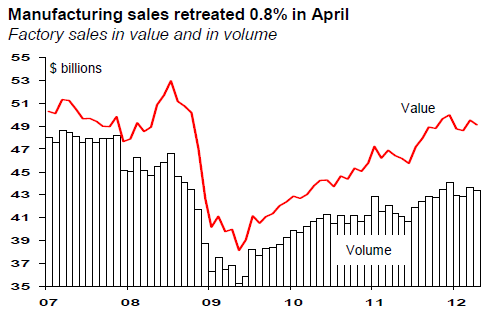

Canada’s manufacturing sales retreated 0.8% in April after a 1.9% jump in March. Mostly responsible for the decline were declines in sales of aerospace products (-33.7%) and petroleum & coal products (-4.9%). Other contributors were metallic products (-4.4%), non metallic mineral products (-2.4%), machinery (-2.8%) and computer & electronic products (-2.3%). The decline was limited by a 9% surge in sales of motor vehicles. Sales fell in 13 of 21 industries representing about 45% of the manufacturing sector.

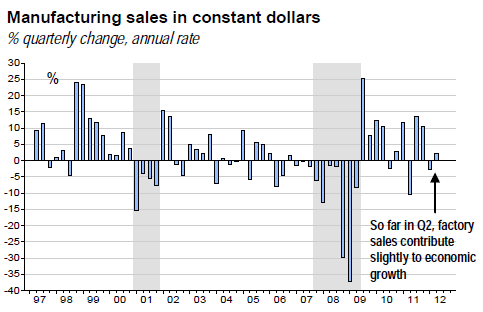

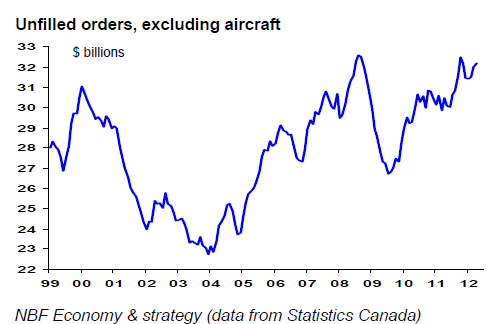

On a regional basis, sales were down in seven provinces out of ten, with New Brunswick and PEI reporting two-digit drops. New orders fell 3.2%, mostly reflecting aerospace products, petroleum & coal products and machinery. Unfilled orders were flat in April, as declines in aerospace products (-0.5%) and other transportation equipment (-3.4%) were offset by advances in metal products (+2.9%), wood products (+2.8%), machinery (+1.1%), computer & electronic products (+2.8%) and electrical products (+3.3%). Inventories rose 1.0% in April, aerospace products (+5.1%) being the largest contributor. The inventory-tosale ratio increased 0.02 to 1.32 in April. In constant dollars, manufacturing sales declined 0.6%.

Opinion: Canadian manufacturing sector is affected by the ongoing economic soft patch in North America (top chart). However, part of the weakness in April can be attributed to temporary shutdowns at some refineries. Looking ahead, prospects are nevertheless not that bad. Indeed, in food, machinery and fabricated metals, unfilled orders have increased lately to record levels. Overall, unfilled orders excluding aircraft are close to a record level (middle chart). Also encouraging is the fact that 36,400 manufacturing jobs were created in May. Even with April’s decline, manufacturing sales contribute slightly to economic growth after one month in Q2 (bottom chart).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Manufacturing Sales Retreated In April

Published 06/17/2012, 03:06 AM

Updated 05/14/2017, 06:45 AM

Canadian Manufacturing Sales Retreated In April

Facts:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.