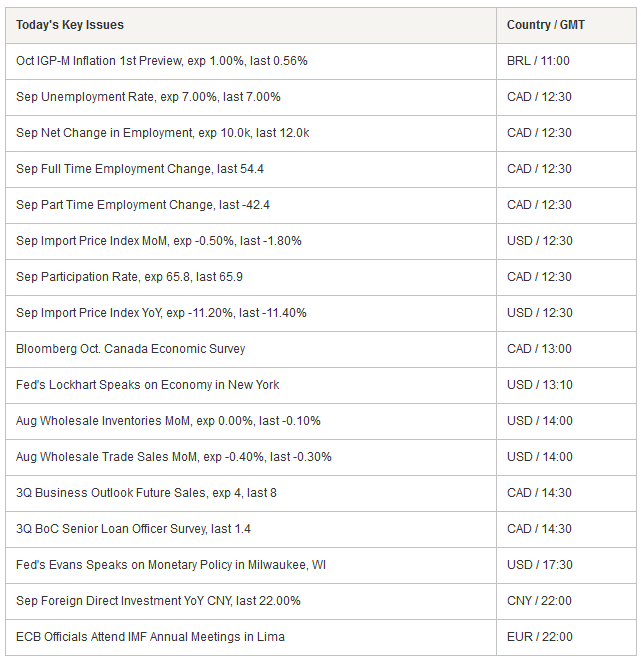

Commodities prices are weighing on the Canadian economy. For the two first quarters, GDP shrank 0.8% q/q and 0.5% respectively. However, the Canadian economy expanded 0.3% in July. In our view this was due to the temporary surge in oil prices at that time. Meanwhile, volatility is still massive so the fundamentals remain at stake and crude oil prices collapsed below $40 a barrel in August. When commodities collapse, Canada holds it breath. As a result Canada’s trade deficit has widened to $2.53 billion in August from $0.59 billion in July and exports has dropped 3.6%, which represents their biggest decline since January 2012.

The Bank of Canada has already cut rates twice this year in an effort to offset the effects of the oil decline. The new rate decision meeting will be held on October 21. We believe that the monetary policy will remain unchanged at 0.5% as the recent surge in commodities should provide some traction to the Canadian economy.

On top of that, unemployment data for September will be released today. The data is expected to remain unchanged at 7%. A weak read of this week’s employment report could be interpreted as a possible contagion from the U.S. We remain bearish on the loonie, which is holding below 1.3000 versus the greenback. On the medium term, we target the USD/CAD to go back to 1.3200.

FOMC Minutes: not even close to hike rate (by Peter Rosenstreich)

The debate over the Fed meeting minutes is in full swing this morning. From our vantage point, the FOMC minutes reflect the dovish tone of the September 17th statement rather than the hawkish comments delivered afterwards. In our interpretation of the minutes, the well-publicized view that this decision was a close call is unfounded. In fact we saw nothing that really suggested that a September rate hike was on the table. The committee remains split, but the strength of the doves’ arguments looks to have won out. The minutes focus on low inflation and anxiety over global volatility above emphasizing strong labor markets (main cusp of hawkish members’ argument). In clear wording that global risk had taken prominence over domestic factors, the committee stated:

“risks to the outlook for economic activity and inflation, decided that it was prudent to wait for additional information confirming that the economic outlook had not deteriorated and that inflation would gradually move up toward 2% over the medium term.” Then commenting further: “global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term” to push home the significance. Market reaction was minimal with a slight shift lower in rates and a softer USD, while emerging market and commodity currencies continue to be the primary beneficiaries of a less probable 2015 rate hike. With the threat of a near term Fed rate hike curtailed, FX traders are actively seeking yield enhanced high beta currencies such as IDR, RUB, MYR and BRL. Interestingly, the Fed has trapped itself in a difficult position. The “third” mandate indicates that a hike will only occur when there is stability in global markets. Yet the primary catalyst for volatility is directly related to the Fed’s hiking expectation (not Asian growth prospects as some have suggested). In the current environment, the USD upside should be limited against G10, however we could see some significant recovery in the much maligned EM currencies.

GBP/USD - Fading Below Resistance At 1.5383

The Risk Today

Yann Quelenn

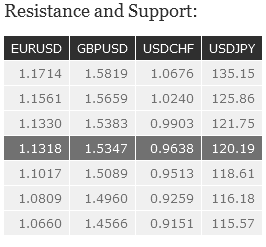

EUR/USD has moved sharply higher and has broken hourly resistance at 1.1330 (21/09/2015 high). Support can be found at 1.1087 (03/09/2015 low). Stronger support lies at 1.1017 (18/08/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We remain in a downside momentum.

GBP/USD's momentum is fading. Hourly resistance can be found at 1.5383 (22/09/2015 low). Hourly support can be found at 1.5087 (05/05/2015 low). Stronger support can be found at 1.4960 (23/04/2015 low). In the longer term, the technical structure looks like a recovery. Strong support is given by the long-term rising trend-line. A key support can be found at 1.4566 (13/04/2015 low).

USD/JPY is moving sideways. The pair is still moving around the 200-day moving average. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF has broken the symmetrical triangle. The downside momentum continues. The pair now targets hourly support at 0.9528 (18/09/2015 low). The pair still holds below hourly resistance at (25/09/2015 low). In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).