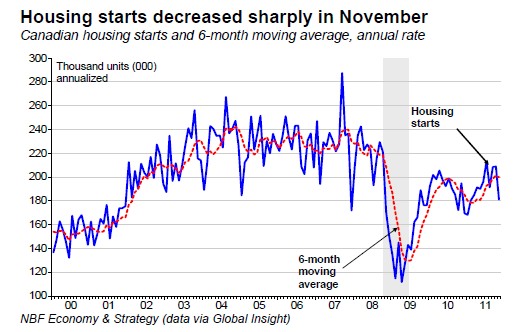

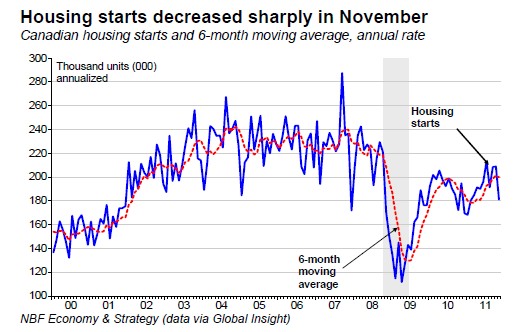

FACTS: Canadian housing starts decreased sharply to 181.1K units in November from an upwardly revised 208.8K in October. Urban starts decreased to 158.9K from 185.7K the previous month. Starts in rural areas decreased to 22.2K from 23.1K. Single family starts increased 3.6% to 63.6K while multiple starts plunged 23.3% to 95.3K. On a regional basis for urban areas, Ontario (-30.6% or -22.0K) and Saskatchewan (-26.8% or -1.9K) showed the strongest pullbacks while Prince Edward Island (+57.1% or +0.4K) and Newfoundland & Labrador (+20.0% or +0.4K) registered the biggest increase.

OPINION: We anticipated a moderation of activity in new home construction over the coming months. November's performance could be a sign of this, but it

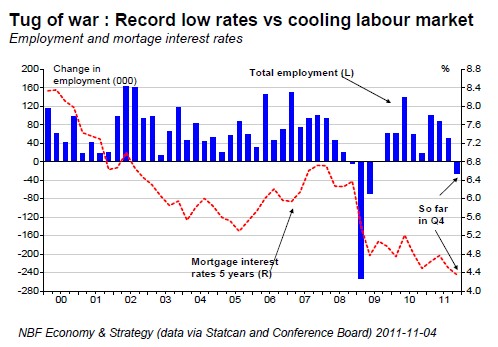

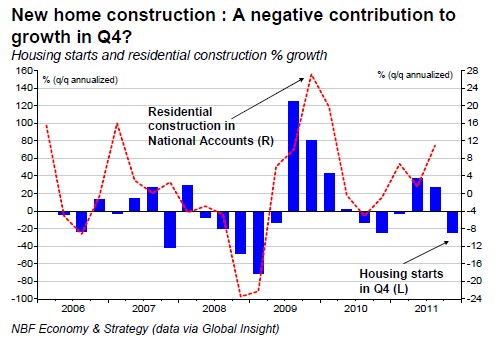

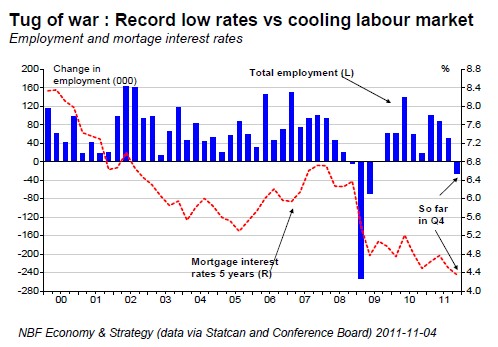

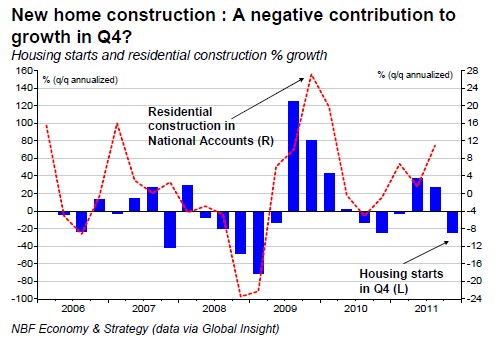

remains that the decrease in activity is concentrated in Ontario (explaining 80% of the overall decline), due to a sharp drop in the highly volatile multiple segment. We will have to wait for another month of data to confirm if the moderation is really taking place. The fact remains that 7 of 10 provinces experienced a drop in November while mortgage interest rates reached an all-time low in Canada. This could be a sign that despite this highly stimulative environment, housing starts should be in line or below our estimate of household formation of 190K in the coming months, especially with a labour market that is experiencing difficulties as of late. What does all this mean for economic growth in Q4? Housing starts are down 25% annualized with two months of data in the quarter, which will negatively impact residential construction - this after experiencing its fastest growth (10.9%) in 6 quarters in Q3.

OPINION: We anticipated a moderation of activity in new home construction over the coming months. November's performance could be a sign of this, but it

remains that the decrease in activity is concentrated in Ontario (explaining 80% of the overall decline), due to a sharp drop in the highly volatile multiple segment. We will have to wait for another month of data to confirm if the moderation is really taking place. The fact remains that 7 of 10 provinces experienced a drop in November while mortgage interest rates reached an all-time low in Canada. This could be a sign that despite this highly stimulative environment, housing starts should be in line or below our estimate of household formation of 190K in the coming months, especially with a labour market that is experiencing difficulties as of late. What does all this mean for economic growth in Q4? Housing starts are down 25% annualized with two months of data in the quarter, which will negatively impact residential construction - this after experiencing its fastest growth (10.9%) in 6 quarters in Q3.