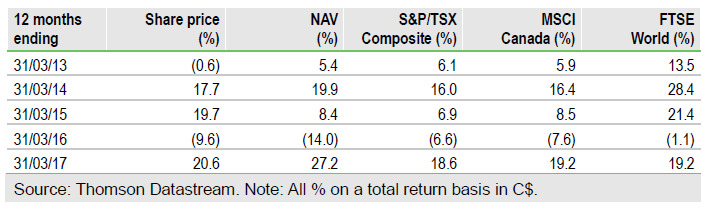

Canadian General Investments (CGI) is registered as a Canadian investment corporation, which confers favourable tax status; it is listed on both the Toronto and London stock exchanges. Given its broad exposure to primarily Canadian equities, the fund may be considered as a ‘one-stop-shop’ for investment in Canada. CGI’s NAV total return has outperformed the S&P/TSX Composite index benchmark over one and five years. The manager’s high ownership of CGI ensures that all shareholders’ interests are aligned; however, this may be a factor in the size of the discount. Emphasis is moving more towards regular, quarterly rather than year-end special dividends; CGI’s current dividend yield is 3.6%.

Investment strategy: Diversified Canadian exposure

Manager Greg Eckel selects stocks on a bottom-up basis, with a consideration of the macro environment. He seeks companies with good fundamentals and strong management teams, which are trading on reasonable valuations. Exposure is broad and the major active positions on a sector basis are overweight consumer discretionary, technology and materials, while the fund remains underweight financials. The majority of holdings are Canadian equities, although exposure of up to 20% is permitted in US equities to take advantage of investing in business areas that are unavailable in Canada. Gross gearing is C$150m, split equally between preference shares and bank debt.

To read the entire report Please click on the pdf File Below