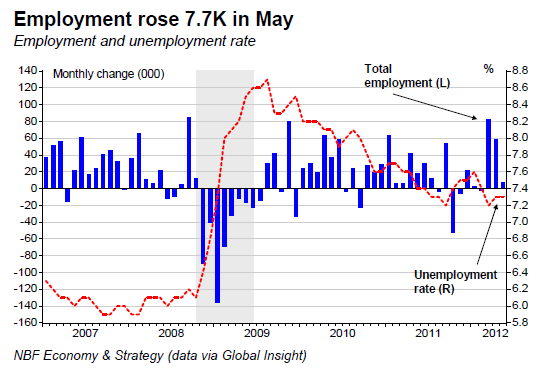

: Total employment rose 7.7K in May following astonishing gains of 140.5K jobs in the two previous months. Both full-time (+1.4K) and part-time (+6.3K) jobs edged up. The goods-producing sector was up 11.1K, following a solid gain of 70.0K the previous month. Within the goods-producing sector, manufacturing (+36.4K) and agriculture (+10.7K) were the top performers. The services producing sector edged down (-3.4K), a second monthly drop in a row. Among services producing sector, Information, culture & recreation (-27.3K) and professional, scientific & technical services (-12.5K) were the worst performers while educational services (+25.7K) and trade (+23.6K) alleviate the fall. At the provincial level, only 4 provinces posted increases in employment. Quebec’s (+14.7K) experienced the largest gains while Ontario (- 18.7K) lagged. The unemployment rate remained unchanged at 7.3%.

Opinion: All and all, the May jobs report showed a good performance of labour markets when considering the unusual volatility of the recent data and the surge of employment observed in the two previous months (top chart). Private jobs were down 22.5K during the month but we are not overly worried given the outsize gain of 128.4K in March and April. However, services jobs seem to be in a soft patch as they were down 4 times in the last 5 months and remain below the peak level reached last September.

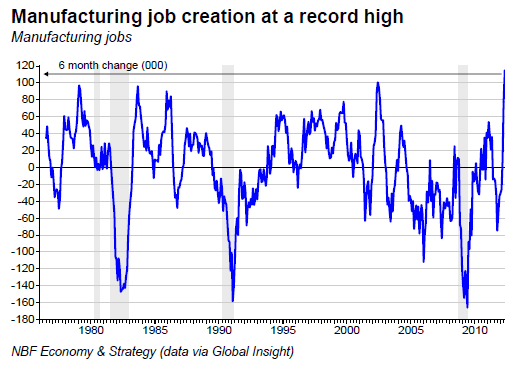

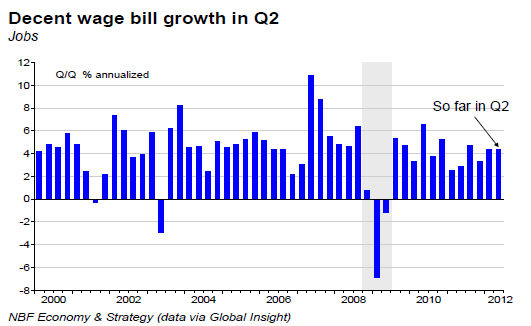

Fortunately, the goods-producing sector picked up the baton over that period thanks to a particularly solid performance of the manufacturing sector. Over the 6-month period ending in May, the manufacturing sector created 115K jobs, its best showing on record (middle chart). It is true that we are far from having recouped all the jobs lost in that sector over the past years but the recent momentum is impressive. By comparison, Canada (+72K) created more manufacturing jobs in the last three months in absolute terms than the U.S (+63K) – an economy roughly ten times larger. With two months of data in the quarter, the Canadian wage bill is growing at a decent 4.4% pace. This development combined with moderating inflation should support consumption in Q2.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Employment Rose In May

Published 06/10/2012, 05:47 AM

Updated 05/14/2017, 06:45 AM

Canadian Employment Rose In May

Facts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.