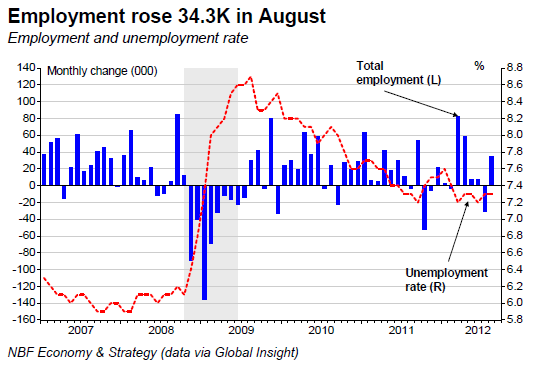

Total employment surged 34.3K in August following a drop of 30.4K jobs in July. Full-time jobs were down (-12.5K) while part-time jobs soared (+46.7K). The goods-producing sector was down 36.4K, a third consecutive monthly drop. Within the goods-producing sector, construction was the worst performer (-44.0K, the worst monthly decline since 2008).

The services producing sector posted strong gains (+70.6K), after a decline (- 17.0K) the month before. Among services producing sector, transportation and warehousing (+37.1K) and professional, scientific and technical services (+20.0k) were the top performers while information, culture and recreation (-17.2K) experienced a sharp drop.

At the provincial level, seven provinces posted increases in employment. Quebec experienced the largest gains (+32.5K) while Ontario showed the biggest loss (-24.9K). The national unemployment rate remained unchanged at 7.3% as the job gains offset the impacts of the increase in the participation rate.

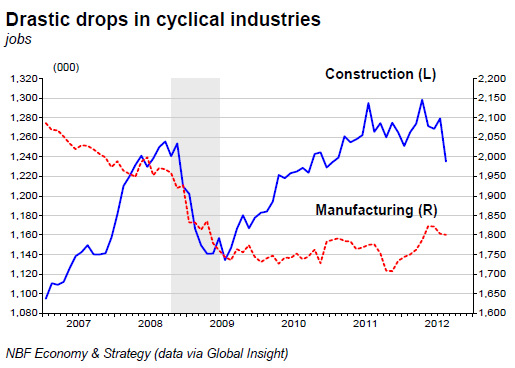

OPINION: The report is worse than it looks, with employment propped up by part-time positions. We are particularly worried about significant declines in cyclical industries. The construction sector experienced a drop of the magnitude not seen since the last recession while the manufacturing sector, not surprisingly, doesn’t seem to be immune against the current worldwide slowdown, showing a third consecutive monthly drop in employment. The stunning performance of education lately casts some doubt about the real strength of the labour market.

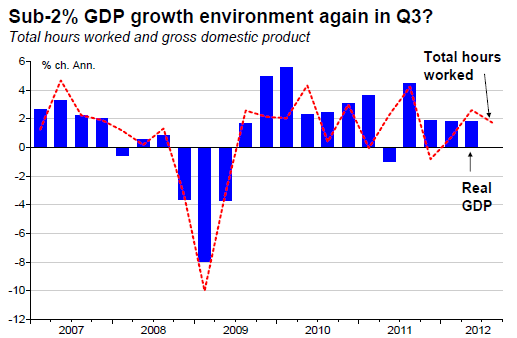

We expect a reversal in that particular sector soon. Another sign that job creation should not be stellar in the months to come is that small and medium businesses confidence index fell for a fifth consecutive month at 60.0 in August, reaching its lowest since July 2009. With August's drop, hours worked are now tracking +1.7% annualized in Q3, a deceleration from Q2's 2.6% pace. All told, the details of the report warrant caution about the real economic picture in Canada. The report is a reflection of a sub-2% GDP growth environment.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Employment Rebound In August

Published 09/09/2012, 06:34 AM

Updated 05/14/2017, 06:45 AM

Canadian Employment Rebound In August

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.