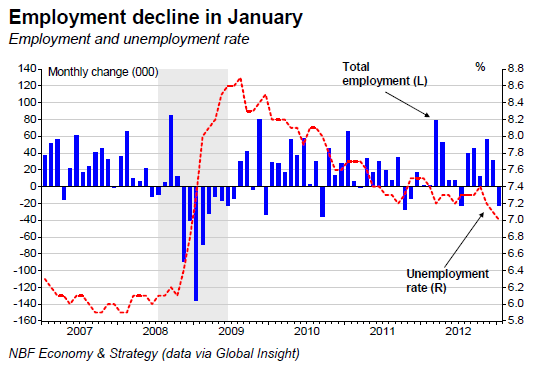

Total employment declined 21.9K in January following a surge of 87.5K over the two previous months. Full-time jobs were down 20.6K and part-time jobs also fell 1.4K. Employment in the goods-producing sector decreased by 17.1K this month (+13.7K in December). Within the goods-producing sector, construction (+17.2K) was the top performer while all other sectors were down with manufacturing (-21.6K) registering the sharpest decline. The services producing sector posted a slight pullback (-4.8K), after increasing 17.5K the month before. Among services producing sectors, educational services (- 30.9K), finance (-10.3K) and health care & social assistance (-8.0K) were the worst performers. However, there were gains in professional, scientific & technical services (+17.2K) and public administration (+15.4K) lagged. At the provincial level, Ontario (-30.9K) and British Columbia (-15.9K) were the worst performers while Alberta (+7.3K) and Quebec (+5.5K) posted the strongest gains. Despite this employment pullback, the national unemployment rate decreased one tick at 7.0%, thanks to the decline in the participation rate.

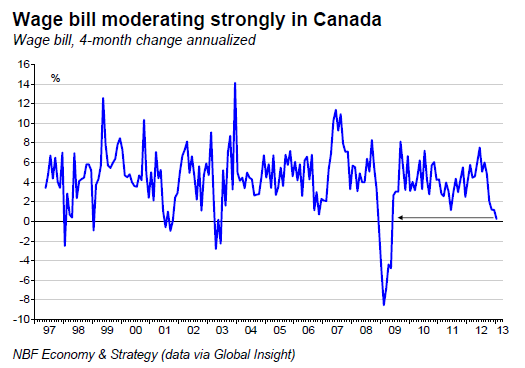

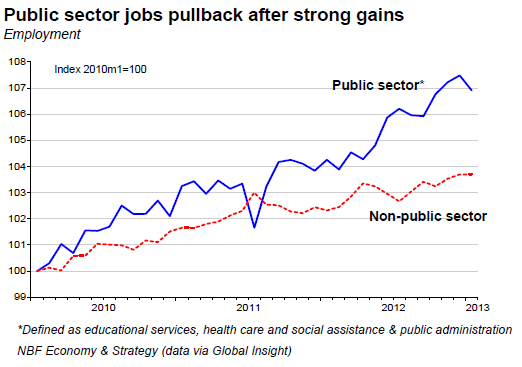

OPINION: January’s labour market performance was significantly below consensus expectations. It was about time that the LFS corrects to reflect the realities of stagnant economic growth. The January report was very weak, not just in the headline, but also in the details with a drop in the number of paid employees, full-time jobs and private sector jobs. Moreover, the wage bill was again stagnant in January – the 4 month change is the worst since the 2009 recession (middle chart). Labour market weakness should continue in the months ahead given the ongoing slowdown in the housing sector (17K increase in the construction sector in January despite a collapse in housing starts!) and the upcoming fiscal drag stemming from the adjustment in provincial public finances. Public sector jobs accounted for a big chunk of job created in 2012, January data indicates that this trend is starting to reverse (bottom chart).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Employment Declined In January

Published 02/10/2013, 05:47 AM

Updated 05/14/2017, 06:45 AM

Canadian Employment Declined In January

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.