Forex News and Events

Expect a Bullish reversal in USD/CAD

From the sidelines today, we will also get Canadian labor figures. Canadian unemployment rate is expected to rise to 6.9% from 6.8% in March while employment should fall -5.0k (downside risk) against 28.7k rise last month. The weakness in the labor data is expected to be driven by further cuts in the oil industry and investment spending. Overall the Canadian economy continues to suffer from lower oil prices and slowdown in the US. Q1 GDP printed flat at 0.0%. Saved from contracting by solid retails and financial services which were able to offset energy sector weakness. Despite the economic deceleration and intense headwinds, Bank of Canada Governor Stephen Poloz insists that economic recovery is right around the corner, as the shock from oil price collapse diminishes. The optimistic outlook helped rationalize the central bank decision to keep the key overnight lending rate unchanged at 0.75% in April. The minutes also indicates that the risks of an additional rate cut this year have minimized. Yet, Mr. Poloz forecasting has been less than stellar plus persistently low Crude Oil prices and slowdown in the US has been deeper than most had expected (reinforced by a weak NFP read today). Indicating that growth and disinflation will continues to plague Canada. The central bank’s expectation of 1.9% growth for 2015 feels aggressive. The sharp housing correction in Toronto and Vancouver could unexpectedly cut into growth, alongside more obvious risks such as drop in investments. Interestingly, while the weak CAD helps exports it also hampers imports of critical machinery and equipment which is needed for new investments. USD/CAD remains in a bearish range between 1.2061 and 1.2165 with crude prices languishing. A bearish break of 1.1945 support area would trigger an extension of selling pressure targeting the 1.1800 handle. We remain bearish on the CAD verse the USD on soft economic data and dovish central banks. A strong challenge to 1.2300/50 resistance would be need to negative current bearish trend and build solid support base.

Swiss CPI lower

Swiss inflation data has come out slightly lower than expected. CPI y/y data came in at -1.1% against -0.9% expected while m/m data fell -0.2% from prior read of 0.3%. Clearly todays data calls in question the recent positive developments in Swiss inflation. This poor CPI read will unlikely force the SNB into renewed policy action (especially consider recent solid growth and labor data) but it will definitely put them on the edge. Indications from sight deposits and IMF data suggests that the SNB has been intervening in the FX markets. Most likely to slow the EUR/CHF deprecation near the 1.04 to 1.0250 range, rather than stop or even reverse the move. We suspect that the SNB has limited appetite for further aggressive measures due to the massive chf30bn loss and growing political backlash over negative interest rates. While the threat of SNB actions will keep CHF traders cautious we don’t expect additional measures anytime soon. We still anticipate a test of EUR/CHF parity near term.

In other news Swiss unemployment continue to improve falling to 3.3% from 3.4% in April. In the last six months only the Swiss region of Ticino loss jobs.

Brazil: expect further rate hikes (by Arnaud Masset)

The Copom April meeting minutes released yesterday indicate that the BCB is firmly committed to reach the 4.5% target throughout 2016. Inflation expectations increased consistently since April’s meeting from 7.47% to 8.26% in 2015 and from 5.5% to 5.6% in 2016, way above mid-point target. Therefore, we strongly believe the BCB will keep tightening its monetary policy by increasing the Selic target rate in the next meeting (June 2 and 3) to 13.50%. However the Copom sounds optimistic regarding the growth outlook of the Brazilian economy as it expects external demand to improve due to higher global growth. Therefore, the BCB doesn’t want to surprise the market on the downside by increasing rates sharply. We therefore expect a 25bps in the next meeting. USD/BRL continues to grind lower toward 3.00 after Monday’s jump and currently sits on the 3.0224 support (Fib 38.2% on January-March rally). We remain bearish on USD/BRL on potential recovery of the Brazilian economy.

High expectations for the US NFP data (by Yann Quelenn)

Today we get US labor report including critical NFP data. Bloomberg Survey indicates new jobs creation of 228K compared to the prior March deceiving soft read of 126K. While estimated have not changed much since Wednesdays soft ADP report printed a 15-month low. Trader will clearly have the downside risk in the back of their minds. We suspect that NFP should be priced well below the current expectations. While ADP has had a history of spectacular misses over the past months, ADP has often been a pretty accurate forecast for the NFP change.

A poor labor read will drive the USD lower, and fuel the main country equity indexes as a US weak economy will push away Fed rate-tightening policy discussion. We think that the EUR/USD may be back on the 1.1300 level.

EUR/GBP - Rejection

Today's Key IssuesCountry / GMT Bank of Italy Report on Balance-Sheet Aggregates EUR / 09:00 May 7 FGV CPI IPC-S, exp 0.64%, last 0.61% BRL / 11:00 Apr IBGE Inflation IPCA MoM, exp 0.75%, last 1.32% BRL / 12:00 Apr IBGE Inflation IPCA YoY, exp 8.23%, last 8.13% BRL / 12:00 Apr Housing Starts, exp 182.0K, last 189.7K CAD / 12:15 Apr Change in Nonfarm Payrolls, exp 228K, last 126K USD / 12:30 Apr Unemployment Rate, exp 6.90%, last 6.80% CAD / 12:30 Apr Net Change in Employment, exp -5.0K, last 28.7K CAD / 12:30 Apr Two-Month Payroll Net Revision USD / 12:30 Apr Change in Private Payrolls, exp 225K, last 129K USD / 12:30 Apr Full Time Employment Change, last -28.2 CAD / 12:30 Apr Change in Manufact. Payrolls, exp 5K, last -1K USD / 12:30 Apr Part Time Employment Change, last 56.8 CAD / 12:30 Apr Unemployment Rate, exp 5.40%, last 5.50% USD / 12:30 Apr Participation Rate, exp 65.9, last 65.9 CAD / 12:30 Apr Average Hourly Earnings MoM, exp 0.20%, last 0.30% USD / 12:30 Apr Average Hourly Earnings YoY, exp 2.30%, last 2.10% USD / 12:30 Apr Average Weekly Hours All Employees, exp 34.5, last 34.5 USD / 12:30 Apr Underemployment Rate, last 10.90% USD / 12:30 Apr Change in Household Employment, last 34 USD / 12:30 Apr Labor Force Participation Rate, last 62.70% USD / 12:30 Mar Wholesale Inventories MoM, exp 0.30%, last 0.30% USD / 14:00 Mar Wholesale Trade Sales MoM, exp 0.50%, last -0.20% USD / 14:00

The Risk Today

Peter Rosenstreich

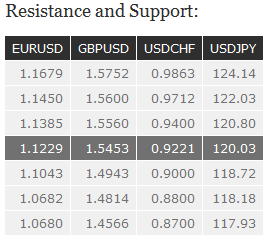

EUR/USD has broken the support found at 1.1334 confirming persistent selling pressures. A further test of strong support at 1.1197 is likely. Hourly resistance now stands at 1.1255 (intraday high). In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD is in full breakout mode confirming persistent buying pressure. Strong resistances can be found at 1.5552 (26/02/2015). Hourly support lies can be located at 1.5420 (intraday low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Key resistance stands at 1.5552 (26/02/2015 high).

USD/JPY remains weak as long as prices remain below the key resistance at 120.10/20 (declining trendline). Hourly support stands at 119.20 (29/04/2015 high and intraday low) then 118.53. Another resistance is given by the recent high at 120.50 then 120.84 (13/04/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favored. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF continues to improve. However, prices are now short-term overextended and close to the resistance at 0.9276 (06/05/2015 high) then 0.9413 (30/04/2015 high). Hourly supports can be found at 0.90 (intraday low). In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).