Investing.com’s stocks of the week

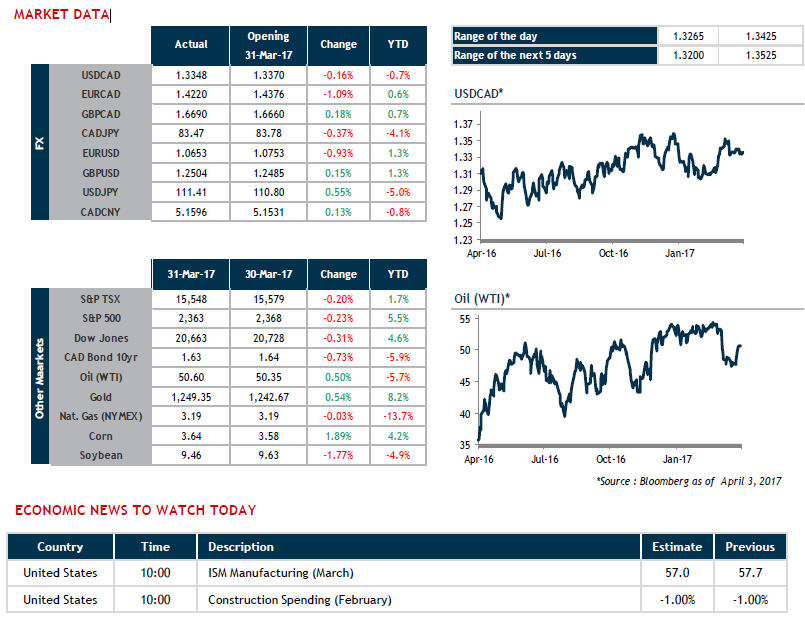

The U.S. dollar ended last week on a high note as confidence regarding the world’s largest economy remained high. European currencies are still fragile due to the long process of taking the United Kingdom out of the European Union, which officially got underway last week. Thanks to impressive economic data, the loonie has proven an exception to the rule and was able to hold its own against the greenback last week. January Gross Domestic Product numbers announced last Friday largely outstripped economists’ expectations, with annualized growth for the past three months reaching 6%, the highest level since 2011.

The National Bank Index of Provincial Economic Momentum (IPEM) for January and February shows that Canadian economic growth for the first quarter of 2017 should maintain the pace seen in late 2016, or 2.6%. It’s hard to imagine that the Bank of Canada will keep interest rates low for much longer with such economic results, which confirm that the oil price shock is a thing of the past.

The high point of this week will be Friday’s release of jobs data on both sides of the border.