Canadian dollar under pressure

The Canadian dollar has been the biggest loser against the US dollar; over the month of December the loonie fell 2.43% against the greenback. USD/CAD spiked to 1.3781, the highest level since June 2004. We expect the loonie to remain under selling pressure against the backdrop of falling crude oil prices and an upcoming rate hike by the Federal Reserve. Moreover, Canada’s new Prime Minister, Justin Trudeau, has promised to run modest deficit to kickstart the economy. Finance Minister Morneau said the country will most likely run a wider deficit, which would reach CAD 3bn in the next fiscal year (starting in March), as the economy struggles in a low commodity price environment. USD/CAD is taking a breather around 1.3680 but expect CAD to continue to depreciate versus the US dollar; the next resistance stands at 1.40 (high from May 21st).

German business sentiment set to increase

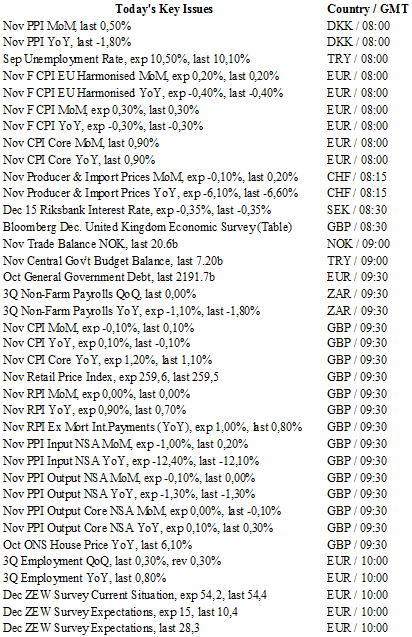

German economic conditions are set to increase. The ZEW index, economic sentiment indicator, is likely to reveal the truth behind this statement today with data expected to print higher at 15 vs. 10.4 in November.

Earlier this week, November final inflation data was released having slightly increased by 0.1% m/m. However, these are two sides of the same coin. The decline in energy prices still weighs heavily on the German economy with exports and industrial production bearing the brunt. Yet, last week’s GDP showed that consumption is the current key driver of the economy. Unemployment data is better and German retail sales have increased backed by more disposable income. The fundamentals remain positive, with Germany being able to run a budget surplus for the past three years.

Germany remains the most competitive European economy. From our standpoint, it is clearly the only European country capable of controlling its debt-to-GDP ratio, which remains below 80%. Other European countries struggle with the inability to debase the currency and continue to see their debt grow. We remain bearish on the EUR/USD and target the pair to head back below 1.1000.

Risksbank hold steady

Today, the Riksbank held is policy rate unchanged at -0.35%, as was widely expected. In the accompanying statement, the central bank stated that it’s stood ready to ease further (were „still highly prepared to react“) even between scheduled meetings should conditions warrant. The Riksbanks indicated that strong economic activity and positive shift inflations expectation support the decision for no action. Adjustments in growth forecasts were increased to 3.7% from 3.3% in 2015, then 3.6% from 3.0% in 2016. On the inflation front, the change was minor with CPI inflation falling to 1.3% from 1.4% in 2016 on the back of weaker energy costs. The less aggressive strategy by the ECB has clearly provided the Riksbank with breathing room while better economic data supported the decision. Despite the widely expected outcome the EUR/SEK dropped to 9.2670 from pre-decision rally of 9.3628. The steady positive development on Swedish growth side and hesitation by the ECB to ease aggressively suggests further SEK recovery in 2016. Break of 9.300 uptrend channel indicates traders will be targeting 9.2213 horizontal support then range lows at 9.1837.

USD/CAD - Bearish Consolidation

The Risk Today

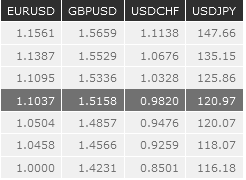

EUR/USD has consolidated lower but the short-term momentum is now bullish. Hourly resistance at 1.1043 (09/12/2015) has been broken. Hourly support lies at 1.0796 (07/12/2015 low). Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD's medium-term downside momentum remains lively. Yet, the short-term momentum is bullish. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Hourly support can be found at 1.4985 (02/12/2015 low). Expected to bounce back at upper bound implied by the downtrend channel. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY keeps on weakening. Hourly support can be found at 120.07 (28/10/2015 low). Hourly resistance still lies at 123.76 (18/11/2015 high). Expected to pursue declining momentum toward support at 120.07. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF has broken hourly support at 0.9876 (27/10/2015 low) while hourly resistance is given at 1.0034 (04/12/2015 high). Expected to show further decline. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

Resistance and Support: