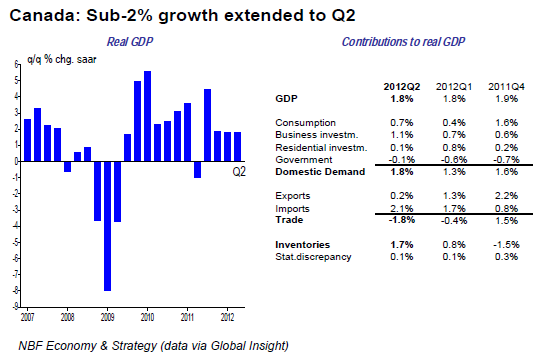

Canadian GDP grew 1.8% annualized in the second quarter of 2012. The prior quarter was, however, revised down one tick to 1.8%. Domestic demand grew 1.7% in Q2 as tepid consumption spending (+1.1%) and the sixth consecutive quarterly drag from government spending offset the strong performance from business investment (+7.2% for machinery and equipment).

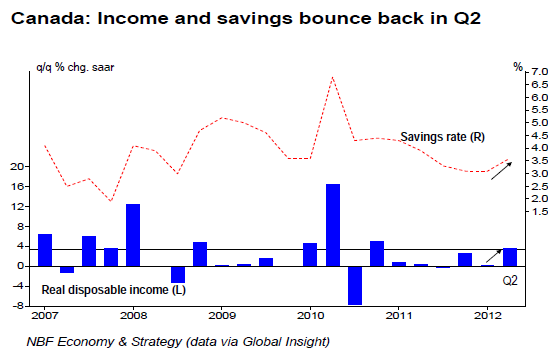

Residential construction grew just 1.7% after a strong Q1. Trade was a drag on growth, as the weak global economy in Q2 caused exports to grow just 0.8% while imports grew 6.4%. With consumption treading water, those imports went into inventories, the latter contributing 1.7% to GDP (top chart). The savings rate shot up five ticks to 3.6% as income grew faster than consumption in Q2 (middle chart). For the first time since the 2009 recession, nominal GDP (+0.5%) grew less than real GDP, suggesting deflation in the quarter.

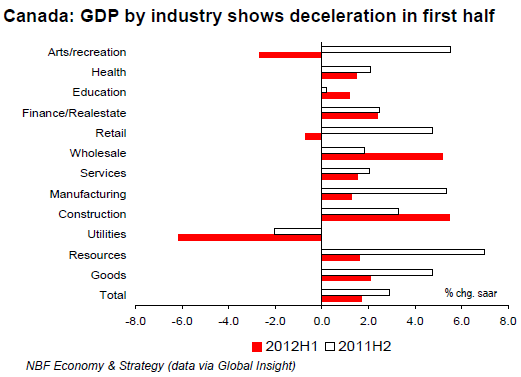

The monthly GDP data showed a 0.2% increase in output in June. The resources sector did well and offset weakness in manufacturing, wholesaling and retailing among others. Still, for the first half of 2012 as a whole, most sectors of the economy show a deceleration from the last half of 2011, including the manufacturing sector and retailing (bottom chart).

OPINION: While it was a bit better than expected, Q2 GDP report was soft in the details, with much of the growth coming from inventory accumulation. The latter is a negative for Q3 production. Domestic demand is set to remain soft with a further moderation in the labour market, the residential real estate activity and modest credit growth, all curbing consumption spending. With Ottawa firm on its balancedbudget goal, contribution from government spending to growth will also be limited.

The outlook for investment spending is a bit better given the corporate cash position and low borrowing rates, but whether that translates into actual investment on the ground depends on the economic outlook at home and abroad, both not looking very enticing at the moment. Trade is unlikely to provide much of an offset to the soft domestic economy, with our main market, the US, seemingly destined for a sub-2% growth environment for the next little while.

From the Bank of Canada's perspective, while Q2 came in exactly as it had estimated, the 1-tick downward revision to the prior quarter means that the output gap may not close next year, assuming it leaves its growth forecasts for GDP and potential GDP unchanged for the rest of the year and 2013. We wouldn't be surprised to see a slightly more dovish BoC statement next week.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Economy Expanded 1.8% In Q2

Published 09/02/2012, 06:04 AM

Updated 05/14/2017, 06:45 AM

Canadian Economy Expanded 1.8% In Q2

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.