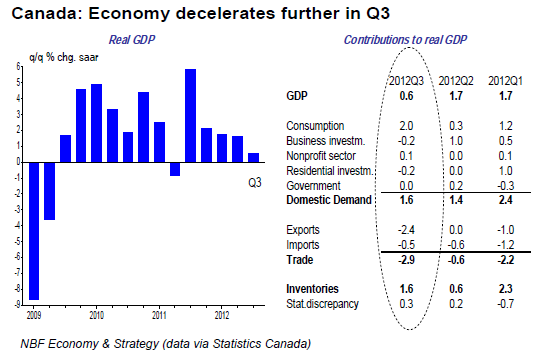

Canadian GDP grew just 0.6% annualized in the third quarter of 2012, two ticks below consensus expectations. Compounding the bad news was the one-tick downward revision to Q2 growth to 1.7%. In Q3, domestic demand was restrained as weakness in investment, government spending, and residential construction offset healthy gains in consumption spending (top chart).

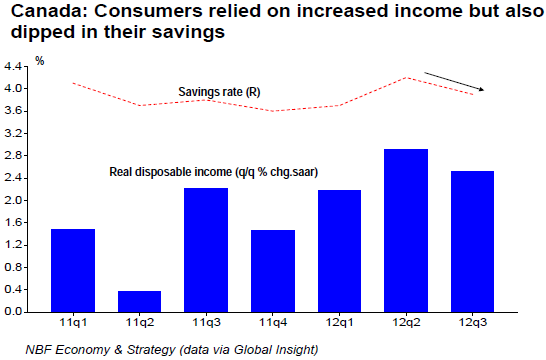

Consumers financed the increased spending thanks to better disposable incomes, although they also dipped into their savings as the savings rate fell three-ticks to 3.9% (middle chart). Trade was a massive drag on Q3 growth (the 7.8% contraction in real exports is the worst since the 2009 recession), not surprising given the weak global economy in Q3. For the third quarter in a row, inventories helped boost GDP (final sales were actually down 1% in Q3).

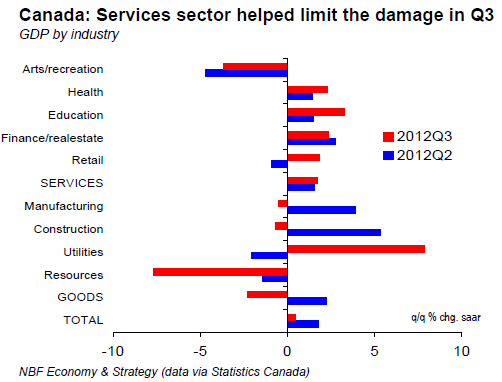

The monthly GDP data showed flat output in September. Manufacturing, construction and retailing saw small gains which offset output declines in the energy sector among others. For Q3 as a whole, the goods sector contracted sharply as resources in particular took a beating from the global slowdown. The resilience of the services sector helped cushion the blow in the quarter (bottom chart).

OPINION: The Q3 GDP report was very weak in the headline but more so in the details, with much of the growth coming from inventory accumulation. The latter is a clear negative for production ahead. With Q3 growth coming in well below the Bank of Canada's 1% estimate and the downward revision to the prior quarter, the output gap is now even larger than what the BoC expected. While the central bank expects growth to bounce back in Q4 (+2.5%), we're less optimistic, more so with the weak handoff from September.

The global economy is still in a funk (based on the PMI readings worldwide in early Q4), a clear negative for our exporters, while domestic demand could be restrained by a weakening housing sector, and tepid investment from both the private sector and government (more so with the latter's aim to balance the budget sooner rather than later).

Moreover, consumption spending which regained some vigour in Q3 now face challenges brought by a softer labour market, a mounting debt load, less favourable housing wealth effects and fiscal retrenchment in the large provinces. All told, Canadian GDP growth is likely to remain below potential for the next little while.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Economy Expanded 0.6% In Q3

Published 12/02/2012, 05:21 AM

Updated 05/14/2017, 06:45 AM

Canadian Economy Expanded 0.6% In Q3

FACTS:

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.