The Canadian dollar reversed course to the upside a week and a half ago, and its strength is gaining momentum on the back of both a fresh wave of demand for commodities and robust economic data.

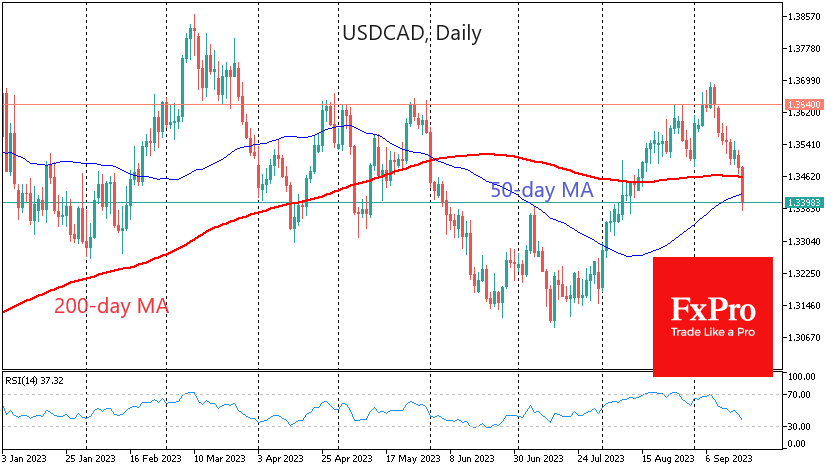

USDCAD is down 1.9% at 1.3430 since 8 September, when the pair reversed sharply lower as it approached 1.3700. Since 2003, the pair has only traded above 1.3700 for relatively short periods at the height of the crisis. The Canadian dollar became attractive for long-term buying as soon as the dust settled after the market crash during the oil collapse in 2015 and lockdowns in 2020.

Over this and the previous years, the Canadian dollar has held back from testing multi-year lows against the USD despite the latter's broad rally. On more than one occasion this year, we have seen the USDCAD sell-off intensify as it entered the 1.3600 area. September is no exception, as we see a similar decline in intensity to that seen in June.

The fundamental news for the Canadian dollar is the rise in oil prices and the fact that US producers are still clearly unable to close their operating deficits. Under these conditions, demand for Canadian crude, which is more expensive and "dirtier" to produce, is increasing. However, the 36% rise in crude oil prices since the end of June has convinced investors that Canadian exports will benefit from the recent price spike. Moreover, it could also be why the Bank of Canada shifted its policy towards more tightening after two months of CPI acceleration.

The latest data, which showed an acceleration in the annual pace to 4.0% from 2.8% in June and 3.3% in July, raised expectations for another rate hike by the Bank of Canada later this year.

USDCAD's failure on Tuesday also carries an important technical signal. The pair broke above both its 50- and 200-day moving averages during the day. The last time this happened was in early June; a sell-off for almost a month followed the signal.

As well as indicating the strength of the Canadian economy, the active decline in the USDCAD may also be a sign of growing risk appetite among North American investors. This could be an important leading signal for global markets.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Canadian Dollar Shows Strength: Could it Head Higher?

Published 09/19/2023, 10:47 AM

Updated 03/21/2024, 07:45 AM

Canadian Dollar Shows Strength: Could it Head Higher?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.